Sweet, sugar, candy plan

One of sugar's biggest players takes a radical step in a new direction. The Wrigley Company talks exclusively to ShelfLife

19 May 2009

***SHELFLIFE EXCLUSIVE ***

The mints and gum category in Ireland is “quite a big deal”, Gareth Streeter, communications manager at Wrigley points out during a recent interview.

With total mouth freshening (that’s mints and gum) valued at €53.4 million, it makes up a fairly significant portion of the overall sugar confectionery market.

Wrigley, which carries a 76.5% value share of the category, gave itself a considerable boost here in January with the launch of Extra Ice Mints in a tin; and so far the results are promising, with figures from February showing Wrigley’s overall share of the mint segment has increased from 7.3% to 8%.

However, in spite of this consistent propulsion of its mouth freshening strategy in Ireland, its next major launch represents a break away from the segment, a move for the Irish market which certainly took us by surprise. Following reports in British trade press that Wrigley was set to launch its premium gum line 5 in the UK, we fully expected its big news for the Irish market to be something similar, or some extension of its existing category strategies here.

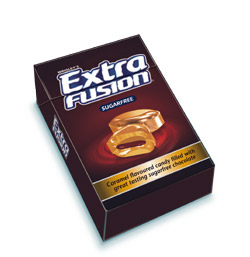

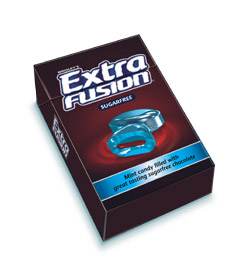

Instead, Wrigley has unveiled a launch for neither mints nor gum, but the sub-category known as ‘other’; Extra Fusion Drops, a sugar-free line of hard shell, chocolate-filled candy for the impulse sugar confectionery segment. While being sugar-free keeps it in line with the Extra brand’s positioning in RoI, the launch is in all other respects something of new direction for Wrigley in Ireland.

Moreover, being the first candy sweets to contain sugar-free chocolate makes the launch even more of a landmark for the confectionery market.

Guiltless on-the-go treat

The unique product offers consumers a sweet treat, in Chocolate Mint or Chocolate Caramel flavours, without the sugar. Pack format is a convenient pocket or handbag-size box, for easy portability, containing 13 drops for a little indulgent, guilt-free treat throughout the day. And at RRP €1.30, they sit at an attractive price point.

Communications manager Gareth Streeter explained the thinking behind the launch: “We just looked at the scope in the Irish market place at the moment and decided that this was something that could really fill a gap and give people a really new treat essentially, which is what this product is.

“It is something we’re really excited about and it’s not something we’ve released before in Ireland. As you know, we’ve stuck to mint and gum, so this is really exciting for us. And there have been similar products, although not identical, in other territories that have been very successful.”

Although the concept may be very simple, it is indeed unique; a combination which has worked very well in many businesses. “Extra Fusion Drops is something that the consumer will get, although it may seem rather ambiguous to the trade, it’s something the consumer will relate to.”

And there is ample research to demonstrate how such a product might fit well with the usage patterns of convenience-led Irish consumers that are constantly on the go, increasingly health conscious, and increasingly in need of treating.

Strategy

Wrigley’s new candies are being strategically released in Ireland under the Extra Fusion brand. “It’s about mixed up flavours and sort of a fresh taste experience, and that’s why this is going under

"Extra Fusion, it’s something the Irish consumer really understands is about a new taste experience"

,” Streeter explains.

As opposed to Extra which most Irish people identify with breath freshening; by contrast, the new drops will be released under the Extra banner in Scandinavia.

In general, Wrigley’s NPD arises from a two-pronged approach, consisting of product development and innovation at its central Chicago facility, and its specific research work in individual territories. “We would never roll something out uniformly,” says Streeter, “in this sector generally every country has slightly different needs, different taste profiles. So it’s really important for us that, as well as getting our central innovation right, we’re developing products that are appropriate for each market.”

Taking mints for example, Extra Ice Mints had existed in a different form (Eclipse brand) in Australia and had been successful there, prompting Wrigley to explore opportunities for the concept in other markets. But rather than simply “dumping it” into Ireland, it had to be revamped following extensive research in Irish consumer usage patterns, the kinds of flavour profiles enjoyed by Irish mint consumers, and their general needs and expectations of this category.

Similarly, intensive research and strategic planning precedes the Irish launch of Extra Fusion Drops, and it has been targeted with a precision The Wrigley Company has down to science. “Within our core Extra chewing gum territory, the main need there is for people to have freshness, and so we have a product that fits that. We’re also aware that there is a real need for a product that enables alertness, or “revitalisation”, which the Airwaves brand aims to meet.

“Over more recent years we’ve realised that there’s this need for indulgence which is where Extra Fusion has really come into its own, and this is where our new product comes in.”

As part of Wrigley’s overall strategy, Streeter says it will continue to look for “different touch points for different consumers. We look at the different things that consumers could want out of a product and we try to produce something that is going to meet as many of them as possible. We’re constantly trying to think about what consumers need, how those needs are evolving, and to ensure that our portfolio of brands is really up to speed with that.”

Throughout the FMCG world, The Wrigley Company has proven itself a master strategist where NPD is concerned, so it will be interesting to watch this space; although something tells us we’re looking at another Wrigley success, and a bit of a boost for sugar confectionery.

Wrigley’s Extra Fusion Drops will be available to retailers from 1 June. The launch will be supported by TV and extensive sampling after release.

VITAL STATS

• Total mouth freshening (gum and mints) is worth €53.4 million in RoI

• Wrigley has a 76.5% value share of the mouth freshening category

• Total chewing gum segment is worth €39.8 million in RoI

• Total mints is worth €16.1 million in RoI

• Extra leads the gum category in RoI with a 67% share, and is now worth €26.6 million

• 80% of Wrigley’s Extra Gum chewers only use this brand (Source: Dunhumby 52 w.e. 30.11.08 Northern Ireland)

• Airwaves has a 16% value share and Orbit has 9.1% value share in RoI

• Extra Ice Mints are number one sugarfree mint brand, with 74% value share (ACNielsen 52 w.e. 02.11.08)

• Hubba Bubba is Ireland’s number one bubblegum brand, with 57% share of segment

Source: ACNielsen 52 w.e. 22.02.08 unless stated otherwise

Sweets of heritage

Launched in 1881, Nestlé’s Fruit Pastilles are the oldest line in the portfolio, and hold a special place in the Irish market

Polo is one of Ireland’s favourite mints and is Nestlé’s number one mint brand.

Polo established its catch-phrase ‘the mint with the hole’, for which it will forever be known, and also has a strong brand heritage in RoI.

The Polo range offers a variety of products, including Polo Original, Polo Spearmint, Polo Sugar Free and Polo Fruits.

Nestlé Rowntree is the number one brand in impulse sugar confectionery

Nestlé Rowntree is the number one brand in impulse sugar confectionery. Nestlé Fruit Pastilles were launched in 1881 and have a strong heritage in the Irish Market.

Rowntrees offers an extensive range both in impulse and take-home confectionery including tubes, multipacks and hanging bags. All products now contain 25% real fruit juice and have no artificial colours or flavours.

VITAL STATS

• Nestlé Rowntree is the number one brand in impulse sugar confectionery

• Launched in 1881, Nestlé Fruit Pastilles are the oldest line in the Rowntree portfolio and have a strong heritage in the Irish market

• All Rowntrees products from Nestlé now contain 25% real fruit juice and have no artificial colours or flavours

• Polo is one of Ireland’s favourite mints and is Nestlé’s number one mint brand

• Polo mints originally had no hole when they first came to market in 1948, only gaining it in 1955

• In the UK, an estimated 150 Polo mints are eaten every second

Print

Print

Fans 0

Followers