Caffé Nero, Costa Coffee and Starbucks close competitors for customer loyalty

Driving awareness and adoption of mobile apps can help coffee brands capture more wallet share, according to Cheryl Flink, chief strategy officer, Market Force

19 March 2015

The UK’s favourite coffee shop/snack chains are the two brands out of five surveyed not available in Ireland, namely Prêt à Manger and Greggs, a new survey reveals.

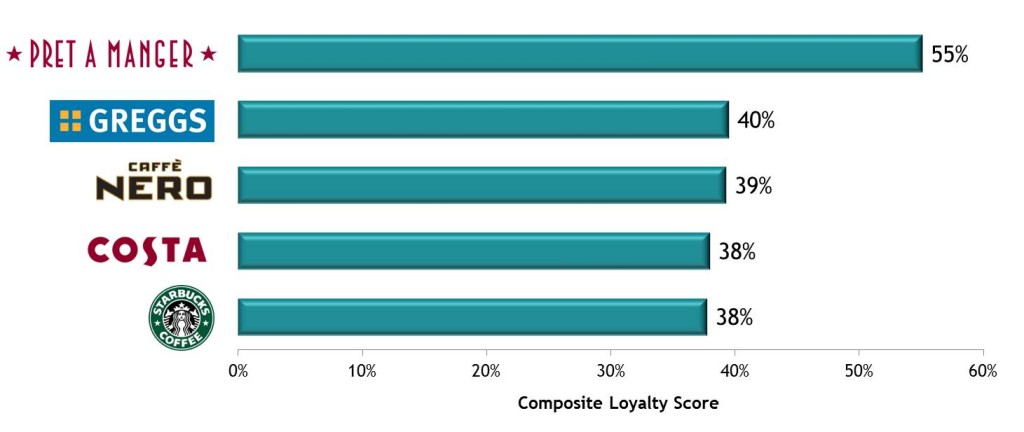

A national UK survey by Market Force Information shows consumers rate Prêt à Manger and Greggs as providing the best coffee experiences, with overall customer loyalty scores of 55% and 40% respectively. They were followed by competitors, Caffé Nero (39%), Costa Coffee (38%) and Starbucks (38%), all of which have a presence in the Republic of Ireland market.

For the rankings, Market Force polled more than 4,500 consumers in January 2015 to create a Composite Loyalty Index. The research also looked at the attributes that drive consumer preferences for an excellent coffee experience, focusing on eight critical drivers such as service, food quality and value. Consumers found that brands provide good service, clean restaurants, and high food quality, but have opportunities to improve healthy food options.

Consumers rated Prêt à Manger as being the best on seven of the eight critical drivers of satisfaction. Greggs scored best on only one attribute; value received for money spent. Greggs came in second best on friendliness of staff, speed of service, and store cleanliness. When coffee locations score well on the eight critical drivers, 95% of consumers will recommend the brand. When coffee locations excel on only one of those critical drivers, only 34% will recommend them.

Consumers rated Prêt à Manger as being the best on seven of the eight critical drivers of satisfaction. Greggs scored best on only one attribute; value received for money spent. Greggs came in second best on friendliness of staff, speed of service, and store cleanliness. When coffee locations score well on the eight critical drivers, 95% of consumers will recommend the brand. When coffee locations excel on only one of those critical drivers, only 34% will recommend them.

Consumers also indicated whether they used the mobile application offered by brands they had recently visited. An average of 60% across all brands didn’t know there was a mobile app available. When consumers know of an app, they had typically downloaded it. Greggs’ app had the highest adoption rate (68%), followed by Starbucks (58%), Costa (51%) and lastly Prêt à Manger (36%).

“Coffee brands have the opportunity to capture more wallet share in two ways,” said Cheryl Flink, chief strategy officer, Market Force. “First is focusing on creating a great experience through exceptional execution by every location in the estate, which will create differentiation in a market that has become very competitive. Second, brands can drive awareness and adoption of mobile apps to create a convenient, hassle-free experience.”

Print

Print

Fans 0

Followers