Soft serve

Armed with the latest exclusive research from Reep Insights based on consumer data from across more than 90,000 shopping trips, Gillian Hamill explores the latest innovations in both flavour and pack formats that are generating refreshing growth within the soft drinks sector

20 April 2016

AT A GLANCE: SOFT DRINKS

- 7up Mojito Free which began rolling out in Ireland in March 2016, building on a successful launch in France, is available in both 500ml and 2l bottles

- Ballygowan is Ireland’s number one water brand, the fifth biggest brand in the Irish soft drinks market by value and third biggest brand by volume*

- Ballygowan is tapping into the consumer demand for healthier options and delivering strong growth of 24% MAT*

- Ballygowan delivered an additional €4million retail sales in the last year alone*

- Elderflower remains the Bottlegreen brand’s most popular flavour, accounting for 43% of Bottlegreen’s sparkling pressé and 74% of cordial sales volume. After 27 years, it is still showing strong growth with elderflower sales up by around a third last year**

- Water brand Celtic Pure’s says its latest investment in facilities will increase its annual production capacity by 65% and see annual turnover rise twofold by 2017. Celtic Pure aims is to bring the business to the stage where it can target sales of €18 million to €20 million

- Research shows consumers are seeking smaller, shareable packs that can fit into smaller supermarket baskets as well as larger packs for the ‘main shop’. Coca-Cola says its wide variety of new take-home options will fit consumers’ changing lifestyles and shopping missions

- The 500ml Deep RiverRock Still bottle, which accounts for 90% of the total Deep RiverRock 500ml volume, now uses 16% less PET. A reduction in plastic from 22g to 18.5g will result in an estimated 135 tonnes of plastic removed from the manufacturing process annually

- Shloer’s 2016 year to date sales in Ireland are up by more than a third (35%) compared with last year***

- Less than a year since the launch of Shloer Light, the two Shloer Light Red and White variants now account for a fifth of the brand’s sales in Ireland.**** This is before factoring in sales over Easter which is the second biggest sales peak for Shloer

- Shloer Celebration Pink Fizz and White Bubbly saw sales rise by 10% following the roll-out of a new pack design***

- Vimto is the UK’s fastest growing squash brand at +4.6% year-on-year*****

- Vimto Squash and the RTD range continue to go from strength to strength, both growing at +2.1% and +16.4% YOY in the UK respectively******

- The tropical flavoured carbonates sector is growing at +3% YoY in the UK. Levi Roots in impulse is outperforming this market trend by more than five times that rate******

- VitHit was the fastest growing soft drink in Ireland last year

*(Source: Nielsen Scantrack February 2016)

**(Source: Internal Sales Out Data 2015 vs 2014)

***(Source: Internal Sales Data case volume, ROI Multiple Grocers Jan/Feb 2016 vs Jan/Feb 2015)

****(Source: Internal Sales Data case volume as a percentage of total case sales in ROI Jan/Feb 2016)

*****(Source: Nielsen Total Coverage MAT 12.09.15)

******(Source: Nielsen MAT value 15.08.15)

Soft drinks deep dive: Reep Insights

Soft drinks deep dive: Reep Insights

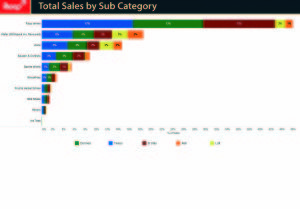

Reep, the data and insights business, reports on the latest trends in the soft drinks category across the top five Irish retailers.

Reep surveyed 4,825 shoppers across 90,937 trips over the seven month period commencing August 2015 through to the end of February 2016. Each of these shopping trips contained at least one item from the following subcategories:

- Fizzy drinks

- Water, still and sparkling including flavoured waters

- Juice, both chilled and long-lasting

- Squash and cordials

- Sports drinks

- Fruit and herbal drinks

- Smoothies

- Milkshakes

Reep found that the supermarket multiples in total comprised some 85% of total sales across all subcategories. Tesco was the most popular over the period, recording a 34% market share.

Reep found that the supermarket multiples in total comprised some 85% of total sales across all subcategories. Tesco was the most popular over the period, recording a 34% market share.

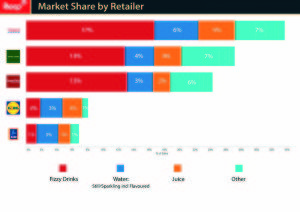

Almost 46% of the category sales can be attributed to fizzy drinks, with water and juice making up another 33% of category sales. While SuperValu recorded just 24% market share over the period, versus 27% for Dunnes, the two supermarkets were equally popular in terms of fizzy drinks alone, each with circa 13% of total market sales.

While ‘fizzy drinks’ was the leading category performer for the supermarkets, the story was different at the discounters, where water represented the majority of sales. For both discounters, juice was the second most significant subcategory, though more so for Lidl than Aldi.

Reep found that fizzy drinks sales tended to peak on the Thursday, whereas water sales were more concentrated on Saturday. SuperValu was a notable exception to this general trend, with water sales tending to fade into the weekend, but with juice sales spiking on Saturdays.

Reep found that fizzy drinks sales tended to peak on the Thursday, whereas water sales were more concentrated on Saturday. SuperValu was a notable exception to this general trend, with water sales tending to fade into the weekend, but with juice sales spiking on Saturdays.

A recent report published in February 2016 by Euromonitor entitled ‘Soft Drinks in Ireland’ showed that bottled water, concentrates and juice experienced a sales increase, while carbonates and sports energy drinks experienced a decline. Nevertheless, new data from Reep Insights shows that almost 46% of soft drink category sales can still be attributed to fizzy drinks, demonstrating this segment’s continuing importance. Furthermore, the Euromonitor report added that ongoing economic recovery implies increased spend on higher-quality soft drinks, suggesting an increase across the category is imminent.

The recent announcement that a sugar tax will be implemented in Britain in two years’ time and the mooted prospect of a sugar tax in this country is obviously a major consideration for soft drinks manufacturers at present. The Irish Beverage Council (IBC), the Ibec group that represents manufacturers and distributors of soft drinks, bottled water and fruit juices in Ireland, recently condemned proposals from various political parties for a sugar tax as pre-election posturing, which will cost consumers money, but do nothing to improve public health. Evidence, rather than electioneering, should inform policy decisions, according to the IBC.

Other countries’ experiences

The organisation pointed to the fact that the soft drinks tax in Mexico has only reduced average calorie intake by 4.7 calories a day and sales in France are at pre-tax levels. In 2013, Denmark scrapped its fat tax because of its economic impact and abandoned plans for a tax on sugar. Despite its introduction in several countries around the world, IBC says no causal link has ever been established between an additional tax on sugar sweetened beverages and a reduction in obesity.

The IBC also pointed out that Ireland’s beverage industry has already taken massive steps to reduce the amount of sugar it puts into the national diet through increased promotion of low and no calorie products (which now account for 50% of the Irish market) and reformulation (changing the recipes) of existing products. Between 2005 and 2012 the beverage industry has reduced sugar in their products by approximately 10% at no cost to the consumer.

UK sugar tax

Meanwhile in the UK, Finance Minister George Osborne said its new sugar tax would start in two years’ time, with the aim of lowering childhood obesity levels. The new measure will apply to drinks with more than five grams of sugar per 100 millilitres.

Osborne added that the tax would have two bands – drinks with more than five and eight grams of sugar per 100 millilitres, and would stand to raise an estimated £520 million a year (€661 million). This money would be used to fund schools’ sports activities. Osborne said the delay in implementation would “give companies plenty of time to change their product mix”.

In recent years, Ireland’s Minister for Health Leo Varadkar and previously James Reilly, have both suggested the introduction of a 20% tax on sugar-sweetened drinks.

The Journal.ie reported that in June 2014, a poll conducted by IPSOS/MRBI on behalf of the Irish Heart Foundation found that 52% of the public were in favour of the tax, compared to 46% against.

Since George Osborne’s announcement in Britain, manufacturers such as AG Barr, the company behind Scottish soft drink Irn-Bru, said it is substantially reducing the amount of sugar in its products, in advance of the expected sugar tax.

Fresh take on iconic drink

7up Mojito Free is available in both 500ml and 2l bottles

To celebrate the arrival of summer, 7up is releasing a fresh take on its iconic lemon-lime drink, introducing the new 7up Mojito Free. By blending the classic 7up lemon lime flavour with the summery, refreshing taste of mint, 7up Mojito Free captures the taste and feeling of summer. Rolling out across Ireland since March 2016, and building on the hugely successful launch in France, 7up Mojito Free is available in both 500ml and 2l bottles. 7up Mojito Free is an alcohol-free, sugar-free beverage, capturing the originality and authenticity that the 7up brand has embodied since its creation in 1929. The launch will be supported by a multi-media campaign entitled ‘Dive into Freshness’ from May.

Refreshingly different: Driving growth in soft drinks

Ballygowan Sparklingly Fruity offers a range of low calorie, low sugar Ballygowan water drinks in a stylish can

It’s well-known that Ballygowan is Ireland’s number one water brand but did you also know it is the fifth biggest brand in the Irish soft drinks market by value and third biggest brand by volume? Ballygowan is tapping into the consumer demand for healthier options and delivering strong growth of 24% MAT – driving sales of water and soft drinks throughout the market (Source: Nielsen Scantrack February 2016). This exceptional performance has propelled the brand to deliver an additional €4million retail sales in the last year alone. Ballygowan states the secret to this success is a commitment to quality, consumer engagement and innovation.

The most recent addition to the range is Ballygowan Sparklingly Fruity – a ‘Refreshingly Different’ range of low calorie, low sugar Ballygowan water drinks in a stylish can. Available in singles and six-packs in three flavours: Apple Elderflower & Lemon, Raspberry & Blackberry and Lemon & Mint. With just 23 calories in a can of Ballygowan Sparklingly Fruity and with no artificial flavours, colours or sweeteners, the range is ideally positioned to appeal to consumers looking for healthier refreshment. Consumers have responded extremely well to the launch – two out of five consumers aged 16-34 have tried it and three out of four of them say they love it. (Source: B&A Quantitative Research November 15)

2016 will be another big year for the brand with a strong above-the-line (ATL) and below-the-line (BTL) support plan for the core brand, including year two of the highly successful Dublin GAA sponsorship, along with a 360 degree support campaign for Sparklingly Fruity.

Blooming good news for elderflower

All four Bottlegreen mixers are now available in 175ml single serve bottles as well as new 500ml sharing bottles

“Elderflower is the key iconic flavour of the adult soft drinks category and is a ‘must stock’ in all stores,” says Amanda Grabham, marketing director – soft drinks at SHS Drinks, whose portfolio includes Bottlegreen – the brand which has been at the forefront of the elderflower revolution for the last quarter of a century.

Since Bottlegreen elderflower cordial was launched in 1989, the portfolio has been consistently expanded to include a wide variety of flavour combinations all created to appeal to the adult palate, and the cordials range now extends to a selection of sparkling pressés and a collection of four classic and contemporary mixers.

“Elderflower and Bottlegreen go hand-in-hand and it’s still our most popular flavour, accounting for 43% of Bottlegreen’s sparkling pressé and 74% of cordial sales volume,*” says Grabham. “And after 27 years, it is still showing phenomenally strong growth with elderflower sales up by around a third last year.*”

In May Bottlegreen will start celebrating the arrival of the 2016 elderflower harvest with a series of events, consumer PR and sampling activity, all of which will highlight the fact that the elderflowers used by Bottlegreen are all handpicked when the blooms are newly opened and at their brightest white.

Elderflower was also the first flavour choice for Bottlegreen’s expansion into the premium mixer category when it launched two new sophisticated and contemporary mixers – bottlegreen elderflower and pink (elderflower and pomegranate) tonic waters. These have subsequently been joined by an Indian classic tonic water and a naturally light mixer. Following the launch of a new pack design across the Bottlegreen range last autumn, all four Bottlegreen mixers are now available in 175ml single serve bottles as well as new 500ml sharing bottles which are being rolled out this spring.

Grabham highlights a special new feature of the new Bottlegreen cordial bottles – the inclusion of a premium non-drip pourer – and adds: “The new pack design sees the Bottlegreen family of cordials, sparkling pressés and mixers united by the same iconic bottle shape, a new logo and the use of hand-drawn botanical illustrations depicting the key ingredients for each of the flavours.”

*(Source: Internal Sales Out Data 2015 vs 2014)

Pure success

Since its humble beginnings in 2000, Celtic Pure water has grown to produce 90 million bottles per annum

2015 was a milestone year for Celtic Pure which celebrated 15 years in business and announced a partnership deal with the FAI as its official water sponsor. The company recently celebrated with a launch event where it unveiled plans for a €5m new bottling facility with guest of honour, Republic of Ireland football manager, Martin O’Neill.

Chief executive of Celtic Pure, Padraig McEneaney told guests: “The investment in our facilities will further create new jobs in the area, increase our annual production capacity by 65% and see our annual turnover rise twofold by 2017. Our target is to bring the business to the stage where we can target sales of €18 million to €20 million.”

Celtic Pure is sourced locally from deep beneath the Drumlin Hills in Co. Monaghan. Since its humble beginnings in 2000, Celtic Pure water has grown to produce 90 million bottles per annum with a wide distribution base nationwide in conjunction with retailers such as Dunnes Stores, Aldi, BWG Group, Gala and Applegreen.

With a pack size for every occasion, the high quality water source has been used by the McEneaney family for the past 300 to 400 years. Not only is the natural spring water sourced locally, the unique bottles are manufactured onsite under a quality management system which reduces their carbon footprint and manufacturing costs.

The fast growing mineral water brand has been on a winning streak of late, with awards such as the Bord Bia ‘Success at Home’ for adaption and innovation and the esteemed SFA’s Manufacturing Company of the Year 2015 for outstanding achievement in business growth and management received in 2015. The sparkling water range is also a recipient of the gold medal from the British Bottlers’ Institute.

The fast expanding water brand is looking forward to an even more successful 2016 as it cheers on the boys in green this summer in France.

For more information, contact Celtic Pure on 042 9691820.

New take-home packs across range

Coca-Cola’s wide variety of take-home options fit consumers’ changing lifestyles and shopping missions

Coca-Cola is introducing a simplified range of take-home PET packs in response to evolving consumer needs.

After extensive market research, consumers indicated a preference for different sized take-home PET packs, with each one linked to a key food occasion. From March 2016, Coca-Cola, Coca-Cola Life, Diet Coke, Coca-Cola Zero, Sprite, Sprite Zero and Fanta will move to 1.25 litre, 1.75 litre and 2×1.75 litre multipack sizes across Ireland and Northern Ireland.

Research shows that supermarket shopping is evolving, with an increase in convenience shopping in larger retail stores and consumers seeking smaller, shareable packs that can fit into smaller supermarket baskets as well as larger packs for the ‘main shop’. The new packs introduced by Coca-Cola will offer consumers a wide variety of take-home options that fit their changing lifestyles and shopping missions.

The 1.25 litre or ‘share for tonight’ pack will cater for those undertaking a ‘small basket’ or ‘top up’ shop; typically those shopping for smaller households or unplanned meals.

The 1.75 litre pack or ‘share with family’ pack is available for the larger ‘main shop’ missions, and is suitable for larger trolleys.

The 2×1.75 litre or ‘share the celebration’ multipack is aimed at big trolley shops and for those consumers seeking value packs for special sharing occasions.

Donna McDermott, channel marketing manager, Coca-Cola HBC Ireland and Northern Ireland said: “With changes in the shopper behaviours and the rise of more frequent, multi-channel shopping trips, we have responded to ensure that we continue to offer consumers the correct pack range for every take-home occasion.

“From smaller households to bigger families, shoppers are looking for packs that suit a basket shop while also still requiring value packs for special sharing occasions. By introducing this new range of 1.25 litre, 1.75 litre and 2x 1.75 litre, we will better meet shopper needs.”

The RRP for the 1.25 litre bottle is €1.90; the 1.75 litre bottle, €2.15; and the 2×1.75 litre bottle, €4.15.

Ripple effect

The 500ml Deep RiverRock Still bottle is now 16% lighter; the latest in a series of sustainability achievements by Coca-Cola HBC

Deep RiverRock has launched a new pack design across its 500ml range, introducing a bold ‘ripple’ effect across the front of the bottle and enhancing the impact of the logo with a higher placement of the label. The new, sleeker, bottle shape better reflects the modernised Deep RiverRock logo, which was refreshed in 2015.

Furthermore, the 500ml Deep RiverRock Still bottle, which accounts for 90% of the total Deep RiverRock 500ml volume, now uses 16% less PET. The Still bottle will see a reduction in plastic from 22g to 18.5g, resulting in an estimated 135 tonnes of plastic removed from the manufacturing process annually.

Deep RiverRock is the local water brand of Coca-Cola HBC, a global beverage company that leads the way on environmental sustainability. In 2015, Coca-Cola HBC was named beverage industry leader on the Dow Jones World and Europe Sustainability Indices for the second consecutive year.

The introduction of a light-weighted bottle is the latest in a series of sustainability achievements by the Ireland/Northern Ireland business and the new bottle will be in circulation in time for Earth Day, 22 April 2016 – a reflection of the company’s support for responsible environmental business practices worldwide.

Other sustainability achievements by the company since 2010 have included a reduction in water usage to produce its beverages of 13% and a reduction of 52% in carbon emissions. The plant in Knockmore Hill in Lisburn has also achieved its target of contributing zero waste to landfill – five years ahead of target.

Oonagh Gildea, marketing manager for Deep RiverRock said: “The new ‘ripple’ design is strong and stylish. With a higher placement of the logo on the bottle, the visibility of the 500ml range will also be enhanced in coolers, allowing the much-loved Deep RiverRock brand to have greater impact and prominence in the marketplace.

Deep RiverRock is an increasingly popular water brand that continues to go from strength to strength. 2015 saw Deep RiverRock reach the number one position in both volume and value for the first time across the island of Ireland, as well as the introduction of a number of innovations including a 1 litre Deep RiverRock Still pack, and a new still flavoured water, Deep RiverRock Strawberry with just 1kCal per 100ml.

Introduced to the Irish market in 1994, Deep RiverRock is a high quality, Irish water sourced from deep beneath the glacial hill of Co Antrim.

For more information about Deep RiverRock or the wider sustainability efforts of Coca-Cola HBC Ireland and Northern Ireland, visit www.Coca-ColaHellenicIreland.com.

Innovation drives sales success

Shloer’s year to date sales for 2016 have increased by 35%, compared to last year

“Shloer has had a great start to 2016 with year to date sales in Ireland up by more than a third (35%) compared with last year,* so the forecast is set for a sizzling summer sales performance,” says Amanda Grabham, marketing director – Soft Drinks at SHS Drinks whose portfolio includes Shloer.

“A significant proportion of the growth is being driven by the new additions to the Shloer range, particularly the Shloer Light and Shloer Celebration lines which have attracted new consumers to the Shloer brand.”

Grabham adds: “The rationale for introducing Shloer Light, which uses the naturally sourced sweetener Stevia leaf extract to deliver 22 calories per 100ml, was to offer more choice by providing Shloer in a lower calorie formulation for consumers who are conscious of their calorie intake, but still want to treat themselves.

“Shloer Light has proved to be an instant hit with consumers. It’s less than a year since the launch and the two Shloer Light Red and White variants now account for a fifth of our sales in Ireland.** This is before factoring in sales over Easter which is the second biggest sales peak for Shloer.”

Turning to Shloer Celebration, now packaged in an elegant new Prosecco-style bottle shape introduced last autumn, Grabham says: “Shloer Celebration Pink Fizz and White Bubbly are also performing well in Ireland, with sales up by 10% following the roll-out of the new pack design.*”

This summer, SHS Drinks is turning the spotlight on Shloer Celebration with a consumer press advertising campaign and a new ‘Just Because’ initiative positioning Shloer Celebration as the drink of choice for everyday as well as special occasions. The campaign will be communicated via social media, competitions and partnerships with lifestyle magazines. Prizes will include personalised ‘Just Because’ bottles of Shloer Celebration Pink Fizz or White Bubbly, party packages and shopping vouchers.

During the summer, retailers will also be able to benefit from tailormade promotional support spanning the entire Shloer range of Shloer White Grape, Rosé, White Grape & Apple, White Grape, Raspberry & Cranberry; Shloer Celebration Pink Fizz and White Bubbly; and Shloer Light Red Grape and White Grape.

For sales enquiries, contact SHS Sales & Marketing on +353 (0) 1 4016200.

*(Source: Internal Sales Data case volume, ROI Multiple Grocers Jan/Feb 2016 vs Jan/Feb 2015)

**(Source: Internal Sales Data case volume as a percentage of total case sales in ROI Jan/Feb 2016)

Range meeting consumer trends

“Health, convenience, customisation and the need for added value are key consumer trends that have impacted the category over the last year and they will continue to be an ongoing focus,” says Emma Hunt, Vimto UK marketing manager.

“Increasing consumer health concerns have affected shopping habits across all soft drink categories,” Hunt adds. “As a business we have invested in recent years to respond to this need. In particular, we have increased our No Added Sugar variants across our RTD still juice ranges including Vimto, Levi Roots and Panda. The recently acquired Feel Good brand offers a range of flavours, containing nothing but natural fruit juice and still or lightly sparkling water.

“Squash is an economical choice for shoppers on a budget with smaller pack formats meeting the increasing trend towards convenience shopping,” she continues, adding that Vimto is the fastest growing squash brand at +4.6%* year-on-year.

“Consumers’ tastes have also changed as they become more experimental,” says Hunt. “This has led to significant growth for tropical and exotic flavours and this trend is set to continue with Levi Roots soft drinks range helping retailers to meet the demand.”

Feel Good’s range of 750ml Sparkling Juice Drinks tie in perfectly with the current trend for healthier drinking.

Earlier this year, Vimto also re-launched its Vimto Minis 250ml Still RTD with a new pack design to reinforce to mums that it meets the needs of kids on-the-go.

The larger Vimto 2L Fizzy and Vimto 725ml Dilute formats are also available as PMP. Vimto Squash and the RTD range continue to go from strength to strength, both growing at +2.1% and +16.4% YOY respectively**.

Within Vimto’s Levi Roots brand portfolio, the new Carnival Flava carbonate is available in a 500ml format ready to drink. The sparkling drink is a mix of mouth-watering peach and papaya that provides a refreshing and exotic taste combination.

Popular flavours Caribbean Crush and Tropical Punch Zero are also available as PMPs. What’s more, the tropical flavoured carbonates sector is growing at +3% YoY. Levi Roots in impulse is outperforming this market trend by more than five times that rate**.

*(Source: Nielsen Total Coverage MAT 12.09.15)

**(Source: Nielsen MAT value 15.08.15)

Innovation is a hit!

VitHit Activitea contains coconut water, B vitamins, Matcha tea and amino acids

Officially the fastest growing soft drink in Ireland last year, VitHit has some innovations up its sleeves. The company has just released a four-pack for kids in two flavours, ‘Orange you brainy’ and ‘Berry cool’.

“Mothers and fathers kept asking us to make VitHit for their kids, as they wanted an alternative to sugar drinks on the shelves. We answered the call and the results so far are great,” says Gary Lavin, founder of VitHit. Now parents can buy VitHit in a take home variety with sports cap and the standard no added sugar, low calories and lots of healthy vitamins.

Another healthy addition to the line is the exciting new flavour Activitea pineapple & coconut. As society is getting way more active, the brand’s customers were looking for a drink which could aid their exercise and recovery without all the nasty sugars in sports drinks. Each bottle of Activitea contains coconut water, B vitamins, Matcha tea and amino acids. It’s a great, low calorie, healthy alternative for when on-the-go, or simply looking for low calorie refreshment.

Print

Print

Fans 0

Followers