Unemployment rate rises as concerns turn to wage pressures and cost of living

Remaining recipients of PUP will now transition to jobseekers’ payments if eligible

12 April 2022

The main unemployment rate was 5.5% in March on a seasonally adjusted basis, up from 5.2% in February but down from a level of 7.7% twelve months 7.7% ago. The seasonally adjusted number of people unemployed rose 11,200 in the month but fell 42,100 in the past 12 months.

“Unemployment rose last month, reflecting what we expect to be another temporary pause in the long-term downward trend we saw for much of last year,” said Pawel Adrjan, economist at global job site Indeed. “Forecasts over the longer term are for a continued decline, with an unemployment rate of 5% by 2024 forecast by the CBI in its latest quarterly bulletin.”

Adrjan added that despite Covid-19 still being with us, from a labour market perspective we have moved into a post-pandemic phase. With the ending by the government of any further Pandemic Unemployment Payments (PUP), remaining recipients, if eligible, will now transition to jobseekers’ payments.

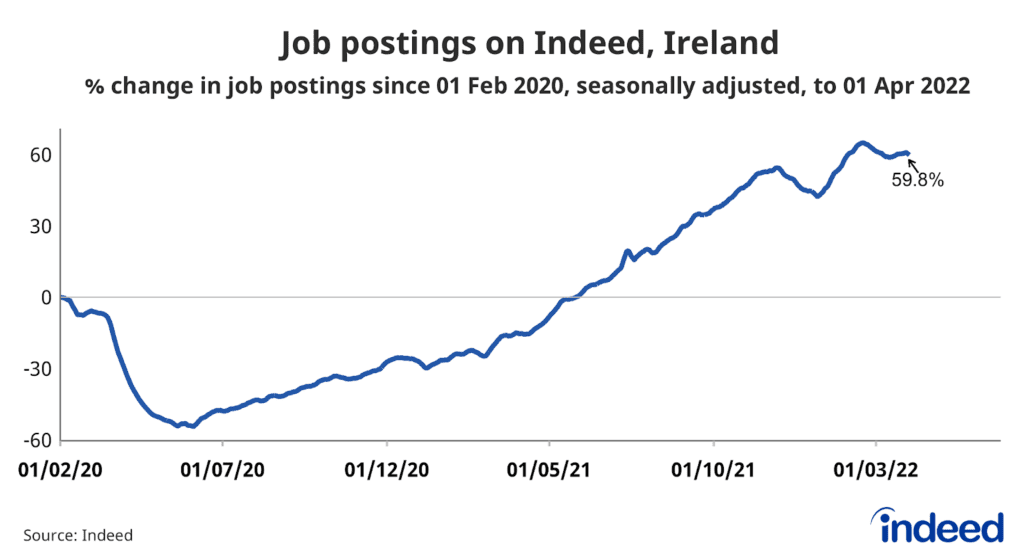

“They will do so in a jobs environment that looks broadly positive,” continued Adrjan. “Indeed’s data continues to show employers very actively hiring, with the level of Irish job postings on Indeed up 60% at 1 April 2022, compared to 1 February 2020.

“However, the current geopolitical situation has created uncertainty, as noted in the CBI’s recent forecast which downgraded their economic growth and employment expectations.

“Of particular concern is the increasing rate of inflation, driven by higher energy costs. With the cost-of-living rising employers are bracing themselves for growing wage demands. In 2021 average earnings growth was 4.8% and in a recent bulletin the ESRI warned that the increased growth in job vacancies is putting upward pressure on wages in 2022. It remains to be seen to what extent workers will look to be compensated for the rising cost of living.”

Print

Print

Fans 0

Followers