ShelfLife Special Tasting: Argentina

ShelfLife's resident wine expert Helen Coburn reports on the best of what Argentina has to offer, as well as delving into New Zealand's export success in the USA

16 May 2017

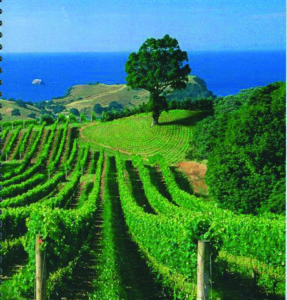

Panoramic view of the Don Paula vineyard in Mendoza, Argentina

Argentina still only accounts for around 2.5% of Irish wine sales. Given that it is the fifth largest wine producer in the world, that’s pretty surprising and indicates that its market here has some potential for growth.

For a long time, Argentina’s red wine category has been dominated by malbec. This has been something of a mixed blessing, for while it’s useful for a wine country to have a signature grape, the fact is that malbec is not the easiest grape to work with. It can run to high alcohol with dense fruit and tend to lack sufficient acidity to balance. That means that some malbec can be rather one dimensional, especially at entry point prices. The best malbec comes from hill sites which are warm but not overheated and, to show its full range of flavour, crop yields need to be restrained. This means that fine malbec can’t be cheap and fans of the grape should head for mid-priced bottles rather than absolute entry point wines.

Irrigation in the Andes Mountains

Wines of Argentina recently held a Dublin tasting and it seemed that at every level, the malbecs were better balanced than they used to be. There were some fine cabernets, too, and, as Argentinian winemakers exploit new hill sites, we can expect to see still more. Almost every cabernet tasted had clear and tasty blackcurrant fruit with decent acidity. Argentina has recently been experimenting with syrah/shiraz. A few were on offer at this tasting but were not always the most convincing of wines. A couple were uneasily poised between European and Australian styles, without showing a very definite character or flavour palate. All were drinkable though, even if one or two were rather expensive, and it is certain that with the variety of sites available to Argentinian producers, we can expect to see some interesting syrah very soon.

Whites always seem to play second fiddle to reds in Argentina but there was a lot of decent chardonnay around. Argentina’s everyday chardonnay has always been a good value choice but some interesting premium bottles are beginning to appear. In the past, torrontes often lacked acidity but that’s something that has been tackled by growers, with better sites and earlier picking beginning to show results.

In 2015, Irish consumers made their way through over 196,000 cases of wine from Argentina; this year is likely to show an increase. Here’s some of what we tasted, with prices approximately retail.

Whites

Whites

Andeluna 1300 Chardonnay 2015 (Celtic Whiskey €16). Unoaked but with ripe flavours and nicely balanced acidity.

Bodega Piedra Negra Alta Coleccion Pinot Gris 2015 (Febvre, independents €15). Soft green fruits with a tropical touch; a nice example of how Argentina is successfully adopting a wider portfolio of grape varieties.

Aires Andinos Sauvignon Blanc 2016 (Findlater, good availability €11). Much of Argentina is too warm for really good sauvignon blanc and it’s essential that sites have decent altitude, with temperatures modified by coastal or mountain breezes. This one’s not bad for its price; soft and easy green fruit flavours make it ideal for a summer get together.

Argento Sparkling Extra Brut Chardonnay (Cassidy, good availability €17). This chardonnay is actually blended with some chenin blanc and Semillon and there’s a pleasing undertow of soft apricot fruit here. Chill well and you’ll have some good value party bubbles.

Callia Alta Pinot Grigio 2015 (Mackenway, good availability €11). With its easy green apple flavours this is a slightly fresher style than the pinot gris above.

Finca Alto Ugarteche, Argentina

Domaine Bousquet Torrontes Chardonnay 2016 (Tindal, independents €14). Torrontes used to be seen as the great white hope of Argentina but it was found that foreign consumers didn’t always take to its quirky, spice and tropical fruit character. Here it’s in interesting company with chardonnay to produce a wine that’s got tasty citrus fruit with just a touch of fresh pineapple.

Don David Torrontes 2016 (Classic, good availability €14). And here is torrontes in all its glory and it’s not half bad. Juicy yellow fruit flavours with just enough acidity to keep it in order. Try with roast chicken or a Chinese stir fry.

The red Malbec grape has become Argentina’s signature

Reds

Premium Bonarda 2012 (Mitchells €20). Rather port-like in character, but still pleasantly balanced and tasty.

Terroir Series Malbec Bonarda Petit Verdot (Liberty, independents €17). Attractive stuff which manages to taste fresh and fruity, without feeling confected.

Portillo Pinot Noir 2014 (Celtic Whiskey €12). Clean, fruity and great value.

Salentein Barrel Reserve Pinot Noir 2014 (Celtic Whiskey €17). A few more euro for a noticeable rise in concentration; again, sound value.

Las Compuertas in Mendoza specialises in fine grapes

Callia Selected Malbec 2015 (Mackenway, independents €15). With six months in oak, this is nicely integrated wine with smooth yet fresh red berry fruit.

Pyros Barrel Select Malbec 2013 (Mackenway, independents €23). Expensive but delivers on its price; skilfully made and aged, this has refreshing fruit with subtle spices.

Luigi Bosca Signature Cabernet Sauvignon 2013 (Barry & Fitzwilliam, good availability €18). Old fashioned in a good way, this has pleasantly evolving dark fruits and smooth tannins.

Dona Paula Ugarteche Cabernet Sauvignon 2014 (Gilbeys, good availability €14). Slightly hearty, country style red with nicely judged oak ageing.

Masi Tupungato Passo Doble 2014 (Findlater, good availability €15). From the Argentinian outpost of northern Italy’s Masi, comes a malbec which is nicely lifted by its 30% corvina. Corvina is one of the classic varieties of Valpolicella, and it adds an attractive fresh cherry note to the heavier malbec.

Trapiche Reserve Cabernet Sauvignon 2012 (Comans, good availability €12). A rather nice touch of age on the palate, with smooth dark fruits and easy tannins. Good value.

USA gives New Zealand something to shout about

Chardonnay growing in California; 66% of wines drunk in the US are local

New Zealand has seen the value of its wine exports to the USA surpass that of Australia for the very first time. Last year, New Zealand sold $400m worth of wine into the US, while the value of Australian wines on that market was $350. These figures are not straightforward. The USA actually imported twice as much wine from Australia as it did from New Zealand but, on average, each bottle of New Zealand wine sold for 250% more than an Australian bottle.

Australian wine exports to the USA have fallen by at least 12% since 2010, with a number of reasons cited. It should not be forgotten that just a couple of years ago, the American dollar was significantly weaker than it is today, while the Australian dollar was strong. This made Australian wines appear more expensive to American consumers and may have altered buying habits which did not always change back again as the dollar strengthened. Another factor is that many Australian wines are broadly similar to those produced in the USA itself so that the category may lack excitement for some consumers. Finally, there has been a growing “premiumisation” of the USA wine trade as the dollar has strengthened, along with increased interest in cooler climate wines. New Zealand is well placed to take advantage of both these trends.

New Zealand vineyard; its producers are strongly challenging Australia in the US market

According to Rabobank’s most recent quarterly report, wines priced at above $11 are increasing sales by double digits in the USA. Wine sales rose 1% by volume in 2016 but by 3% in value. Around 66% of wine drunk in the USA is locally produced, but a good Americans still don’t drink wine at all, so that the market still has lots of growth potential.

One man likely to welcome growth in the US wine market is Donald Trump. Mr Trump has a 1,300 acre estate in Virginia, with 200 acres planted to classic French grape varieties, including cabernet sauvignon, merlot and chardonnay. The wines have been well received by consumers, while Lisa Carley, a well respected New York wine consultant has praised their Old World characteristics. With a price range of €16-30, they’re right in there, competing with the premium New Zealand arrivals.

Wine Trade Ups and Downs

Ups

Rioja continues to be Spain’s most popular wine export and figures released by Pernod Ricard reveal that much of the recent growth in its wine division has been driven by the Campo Viejo Rioja label. Sales for the group increased sales by 7% over the quarter

UK wine producer Chapel Down has revealed a 22% increase in sales to over £6.79m. According to its CEO Frazer Thompson the main challenge for the future is to supply enough wine to meet demand while maintaining consistency of quality. The company has now almost 180 acres under vine and, along with other English wine producers, is hoping that the fall in sterling will attract new consumers, both domestically and abroad.

Downs

Spanish and Portuguese producers of sherry and port are amongst those most worried about Brexit. The UK is the sixth largest export market for port and the largest one for sherry. For sherry the worry is especially acute as, while global sales are falling, they had begun to rise again in the UK. Producers could be strongly impacted by a triple whammy: a fall in sterling, new tariffs and border delays leading to higher market costs.

Severe frost hit several European wine areas during late April. Germany’s Mosel was amongst the regions affected, but the worst damage seems to have occurred in Champagne, where some growers reported a 50% crop loss. A mild March meant that vines were further ahead than usual in growth and this exacerbated matters. This will reduced the size if the Champagne harvest in some regions but producers may not be able to hike prices quite so much as in the past, due to increasing competition from prosecco, cava, and dry sparklers from around the world.

Print

Print

Fans 0

Followers