Trialling change

With many Irish consumers seeing no use for one and two cent coins, Wexford town was chosen to trial the removal of them from the retail sector. David Corscadden spoke to those involved to investigate how retailers and customers have adopted to the change

19 November 2013

Most people have at one time or another found themselves with pockets or jars full of one and two cent coins. In many instances, they will be left there and never return to circulation. Based on a recent survey, which said most Irish customers see no point in the coins, the Central Bank decided to trial their removal from the retail sector.

Irish consumers are very cash and cheque intensive compared to the rest of Europe which is said to be costing the economy money. Ronnie O’Toole, programme manager for the National Payments Plan at the Central Bank, explained: "A billion euro could be saved in our economy if we were more efficient."

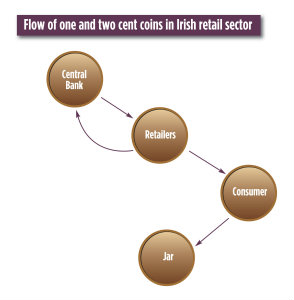

Following consultation with consumers, retail bodies and financial organisations, the Central Bank found Irish consumers don’t like to use one and two cent coins. As a result they are not used as tender in shops so very quickly fall out of circulation. "Retailers give them to consumers and consumers don’t use them and put them in jars. Retailers then come back to the Central Bank and ask for more one and two cent coins as they don’t have enough," said O’Toole.

With so many coins falling out of circulation each year the government is forced to produce more coins to meet the demand from retailers. O’Toole said: "The vast majority of the coins that we produce in Ireland – around 85% – are one and two cent coins."

Wexford town was picked for its strong retail sense and its close resemblance to the national average

Testing the waters

Following a call to Chambers of Commerce around the country, Wexford town was selected to host the trial. Madeleine Quirke, CEO, Wexford Chamber of Commerce, explains that this was viewed as a huge coup for the town. She said: "It was one of the first times that I recall Wexford being in a leadership role where we were able to influence ultimately what would become a national decision. We were absolutely delighted and I felt that Wexford obviously ticked all the boxes for the trial."

Speaking on Wexford being picked as the national trial town, O’Toole said: "The main thing was we wanted retailers and consumers, as many as possible, to see what it was and to make up their own minds and for that we wanted a town that would actively participate and Wexford has a very strong local business community and a very strong business sense."

He also explained that the Central Bank looked for a town that resembled the national average. "It broadly had the same level of unemployment and same socio-economic [breakdown]. Wexford had that in retail as well, with a discounter, a multiple, medium sized stores and boutiques," he said.

Embarking on the trial, the Central Bank hoped for 90 stores to take part but in fact around 240 signed up. Quirke believes two main factors came into play. "That people were delighted to come on board with the project because of the Central Bank or the Chamber or secondly that people themselves felt that it was time to do this trial. I think it was the latter."

The trial has encompassed a number of large events taking place in Wexford which Quirke believes has offered retailers the opportunity to test the scheme and has also given national and international consumers a chance to partake in the trial. O’Toole highlights that Ireland is not the first country to remove one and two cent coins moreover. "It already operates in Australia, New Zealand, Canada, Denmark, Sweden, Finland and the Netherlands. So we certainly aren’t the first country and I suppose we are slightly unusual in that we are in the euro. Finland never introduced the coins and the Netherlands did exactly what we did. They ran a trial in a town called Verden in 2004 and six months later rolled it out nationally."

Voluntary for everyone

Those taking part in the trial in Wexford, both consumers and retailers, could choose to round their money to the nearest five cent denomination or to take their exact change. O’Toole explains that this will be the case if the scheme is rolled out nationwide. He said "Participation in the trial was voluntary and this is also true for a national roll out. If a retailer, even [when the scheme is] rolled out nationally, still wants to accept one and two cent coins, they are absolutely free to do so. If consumers in shops that are participating would rather use the coins or get their exact change they can. So nothing really changes, it is simply a case of if we ignore the coins, they will go away essentially, so we won’t have to produce as much."

Mixed reactions

While overall the trial has been successful in Wexford, both consumers and retailers have expressed mixed opinions on the venture. Antoinette Keogh of Supervalu, The Quay, Wexford, said the store has seen a divide between customers. She said: "Some customers are getting rid of their coins. Then other customers believe it is their money. It is what they are owed and they want it back."

Some retailers in Wexford believe the trial was not really necessary – they believe the coins should not have been introduced when the euro came in. Gary Taylor of Furlongs Family Butchers said: "I think it was inevitable really as everyone thinks they are a nuisance. They should have been gotten rid of when we went to the euro." He also added: "I know it is voluntary but a lot of people seem to round up themselves anyway so they are kind of getting used to it now."

As time went on many retailers felt that consumers became more accustomed to rounding. David Lenard, general manager, Tesco Wexford, said: "Very few people have taken issue with it. The first week, no-one had an issue with it. The second week, some people had a little bit of an issue with it. But since then there has been no issues with it and people have been engaging with it."

Consumer Kathleen Kavanagh believes that people do not mind rounding down but it is rounding up that many people object to. She said: "I think people believe I am paying over for this or under for this, [but] it is more ‘the over’, people would think about. People are paying enough as it is without having to pay extra." This sentiment was also observed by Sarah Culten of local fine food, wine and art retailer, Green Acres. She explained that customers have questioned where the money goes if they do round up. "A lot of people’s attitude to it is that money is better in their pocket than in anybody else’s. A lot of them feel that we are keeping the money," she said.

Taking from charity

Many retailers when asked why consumers didn’t like to take part in rounding, said that many felt they would rather take the change and put it into charity boxes. Many of the consumers ShelfLife spoke to, believed that if rounding was to come in, change that normally would go to charity would disappear.

O’Toole addressed this issue and said: "I can understand that concern but we have already been talking to a number of charities that have approached us and who said in the case of a national roll out they would like to be involved."

He continued: "There is €30 million worth of these coins out there, now they aren’t circulating, they are in jam jars so I think there is a great once-off opportunity for charities to, instead of getting some in dribs and drabs, to earn some money through a concerted campaign over a relatively short space of time."

The next step

Once the trial has been carried out and the feedback has been received by the steering group overseeing the trial, it will evaluate the findings. If in favour of rounding, the group, which comprises the chief executive of the National Consumer Agency, Tara Buckley of RGDATA, representatives of banks, the Central Bank mint ,the Department of Finance and consumers, will make a recommendation to government. O’Toole explains that when a recommendation is made, one of the key steps involved will be a promotion and educating drive to explain to retailers and consumers how the process will work.

Print

Print

Fans 0

Followers