Taxing times

Will a cut in income tax boost spending in the domestic economy? Retail Ireland thinks so. The body predicted a 1.9% increase in consumer spending in 2014 and the potential to create 40,000 new jobs. However with retail still on a knife edge, any increase in business costs could have a severe impact. Anne Brady investigates the repercussions of tackling our taxes

11 July 2014

Retail Ireland demonstrated at its annual conference this year that while sales volume has increased in the last year, sales value has not. This highlights the intense competition that has been an essential component in attracting consumers to spend. This is not a long–term solution and already it has cost jobs and businesses. Retail Ireland has recommended a reduction of income tax for the higher marginal rate of tax. Its view is that high personal income tax has interfered with consumer spending which is resulting in the continued slump in the retail sector. This, in turn, is dulling domestic demand and slowing down the rate of recovery. In May, Retail Ireland stated: “The tax burden is too high and tax on work is way out of line internationally. The entry point to the higher marginal tax rate should be increased, and the marginal rate reduced below 50%. This will put more money into the pockets of Irish consumers, and ultimately benefit the exchequer through greater economic activity and tax revenue.”

Tax in Ireland vs other countries

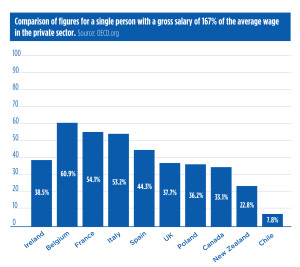

Ireland has a complicated income tax system. At 52%, it has one of the highest marginal tax rates among Organisation for Economic Cooperation and Development (OECD) countries. That is including the universal charge and PRSI. However, it also allows tax credits and tax allowances that other countries do not have. According to the OECD, the average worker in Ireland faces a tax burden on labour income of 26.6% (2013) compared with the OECD average of 35.9%. Ireland was ranked 28th out of the 34 OECD member countries in this respect. Below is a chart with a comparison of figures for a single person with a gross salary of 167% of the average wage in the private sector in different countries, where Ireland ranks 21st out of 34.

Ireland is out-of-line internationally

Economist Fergal O’Brien, IBEC, thinks Ireland is still out of line internationally. O’Brien says: “Ireland is most out of line with income tax in relation to the international top rate of tax. It is the only country in the world where people on low average earnings are paying the marginal rate of tax.” Irish workers start to pay the higher rate of tax (41%) after €32,800. This, says IBEC, can impact on productivity. “We’ve experienced a few members who have challenges around people taking up overtime because they’re giving more than half of that overtime income to the government rather than taking it home themselves. It’s even costing promotions. Employers have reported that employees feel a promotion is not worth it because again, they’re giving half of that extra income to the government. It’s a significant issue for the workplace, a significant issue for the economy and it would hugely benefit consumer spending if we can get some changes. For competiveness, encouraging and retaining mobile workers into Ireland, to incentivise people to do overtime and go for those promotions, we’re going to have to restructure the tax system.”

Building confidence

Income tax makes up 42% of the government’s tax revenue (Jan – Dec 2013, €15,758 million*) and is therefore of vital importance to the exchequer. Would a reduction in income tax result in losses elsewhere?

“It’s a mistake to think that reduction in income tax would lead to a reduction in tax revenue. Considering the experiences we would have had in the 80s when we kept pushing tax rates higher and higher we actually got less tax revenue. Lower tax rates does not have to mean lower tax revenue because it encourages and incentivises more people to work, it creates employment which then increases spending in the economy.”

Consumer confidence took a plunge in May (to 79.4) of this year, its lowest reading since last November and a substantial drop from an all time high the month before (87.2). Is this something that could be potentially significant? O’ Brien thinks this would not be the case. “Already consumer confidence has improved significantly over the last year or so and I think we’re going to see that momentum continue. I think most people can see that the economy is recovering but most consumers don’t have any more spending power in their pockets and that really is a challenge. Having the confidence to go out and spend will create more jobs, more activity and more tax revenue.”

The TASC at hand

TASC, the think tank with a focus on economic equality, disagrees with the idea of an income tax cut. According to TASC, cuts would only benefit one–third of income tax payers and one–sixth of Irish adults. A policy brief released by TASC in June this year stated that those on a lower income are more likely to spend their money in the local economy and higher earners are more likely to pay down debt, not spend in the economy.** When they do spend it is more likely to be on imports and foreign travel. Additionally, many people may end up paying more for services that could be cut if tax revenue falls, cancelling any potential wage increase.*** One of the recommendations laid out by TASC was a reduction in VAT of 1%.

Opportunity cost

The 9% reduced VAT rate introduced for tourism businesses appears to have achieved the desired jolt that the sector was looking for. The impact has been noted for both passing the price on to the customer and through employment increases. Minister Noonan, in his Budget 2014 speech, cited the creation of approximately 15,000 jobs since its introduction in 2011. According to KeepVat At 9%.ie there has been an improved value for money perception for overseas visitors as well as Irish customers. It could also be that the reduction acted as a temporary employment stimulus, either through direct pass or by allowing businesses to hold on to or increase labour without off-setting reductions in margins.**** An alternative approach would be to reduce the cost of creating and retaining jobs by lowering taxes on labour directly. The direct approach may be more efficient. The Jobs Initiative policy that halved the 8.5% employer rate to 4.25% was only implemented on a two and a half year time limited basis, from July 2011 to December 2013. Maintaining the lower rate for longer would have made it cheaper for firms to employ people.

The 9% reduced VAT rate introduced for tourism businesses appears to have achieved the desired jolt that the sector was looking for. The impact has been noted for both passing the price on to the customer and through employment increases. Minister Noonan, in his Budget 2014 speech, cited the creation of approximately 15,000 jobs since its introduction in 2011. According to KeepVat At 9%.ie there has been an improved value for money perception for overseas visitors as well as Irish customers. It could also be that the reduction acted as a temporary employment stimulus, either through direct pass or by allowing businesses to hold on to or increase labour without off-setting reductions in margins.**** An alternative approach would be to reduce the cost of creating and retaining jobs by lowering taxes on labour directly. The direct approach may be more efficient. The Jobs Initiative policy that halved the 8.5% employer rate to 4.25% was only implemented on a two and a half year time limited basis, from July 2011 to December 2013. Maintaining the lower rate for longer would have made it cheaper for firms to employ people.

Indirect taxes

As Budget 2015 looms closer it will be the indirect taxes and austerity cuts that will either make or break consumer confidence and therefore consumer spending. It is yet to be seen if the government will hit the €2 billion target originally promised or ease up on the austerity cuts. The local property tax has only just started. Soon, annual water charges will have to be paid; at the very least they will cost €240 per household. With the addition of controversies such as the medical card eligibility issue, the seed is not being set for a boost in domestic spending. At the beginning of January 2014, the Irish League of Credit Unions, in their ‘What’s Left?’ survey showed that Irish consumers had €182 in disposable income left at the end of the month. A 13% increase from the same time the year before. A further 31% depended on their credit card to make ends meet at the end of the month. The survey also indicated that four in 10 homeowners would have to forego spending in areas like clothing, footwear and groceries to pay the 2014 property tax. Once again, these hits and cuts impact severely on the retail sector.

Recovery

Comparison of tax figures for a single person with a gross salary of 167% of the average wage in the private sector. Source: OECD.org

When evaluating a policy, it is easy to concentrate on how it will fix some particular problem while ignoring or downplaying the possible other side effects. This, in economics, is referred to as ‘The Law of Unintended Consequences’. Of course, these unintended consequences are all too common. A novel strategy on the other hand, to raise the expectations of both workers and consumers, might continue the recovery into 2015.

*(Source: Revenue Commissioners Headline Results for 2013)

**(Source: TASC How much tax do people pay on their incomes? 12 June 14)

***(Source: (http://www.progressive-economy.ie/2014/06/ibecs-proposed-tax-cuts-and-irelands.html)

****(Source: ‘Measuring the impact of the jobs initiative: Was the VAT reduction passed on and were jobs created?’)

Print

Print

Fans 0

Followers