Living it up?

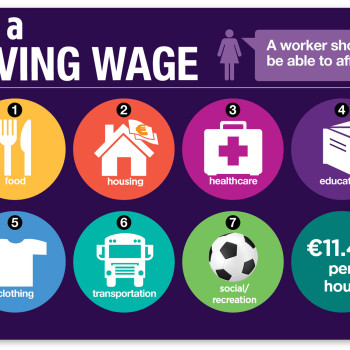

The Labour party is currently backing plans for the introduction of a voluntary scheme, under which employers would agree to pay employees a Living Wage of €11.45. While the idea of improving staff members’ standard of living is an attractive one, is it actually feasible in our current economy? Gillian Hamill reports

11 November 2014

Earlier this year, the Living Wage Technical Group calculated €11.45 an hour is the wage employees need to achieve an agreed acceptable minimum standard of living. The group which was comprised of representatives from groups including the National Employment Rights Institute (NERI) and trade unions, found that earnings below this ‘Living Wage’ level suggest employees are forced to do without certain essentials in order to make ends meet.

Employees currently receiving the national minimum wage (NMW) of €8.65 an hour are likely to welcome proposals to adopt such a system with open arms. However many employers perusing the figures will no doubt baulk – after all, it is a 33% cost hike. Of course, the vast majority of retailers would not want to see employees struggling and would like to pay their staff more where possible. However the difficulty is that margins have taken a hit over the recession-struck years since 2008 and many small retailers and SME owners say they simply cannot afford to pay their staff the new Living Wage rate.

Unsustainable increase for SMEs

ShelfLife recently attended a RTÉ Prime Time debate on this topic. Breda Cahill, who owns three Centra stores, said that while many retailers are actually already paying above the NMW rate, that the 33% hike in wage costs represented by the new Living Wage would be “totally unsustainable”. Speaking from the audience, she said: “The price of groceries in this country hasn’t risen dramatically. I’m currently paying over €800,000 per annum of a wage cost. If the living levy was to come in, it would put my wage bill up to over €1 million. It doesn’t take a scientist to work that out that that would be totally unsustainable for most SMEs in the country.” She added that it would be more beneficial for the government to tackle the high costs of doing business and living costs in this country, such as property taxes, rates and water charges.

ShelfLife recently attended a RTÉ Prime Time debate on this topic. Breda Cahill, who owns three Centra stores, said that while many retailers are actually already paying above the NMW rate, that the 33% hike in wage costs represented by the new Living Wage would be “totally unsustainable”. Speaking from the audience, she said: “The price of groceries in this country hasn’t risen dramatically. I’m currently paying over €800,000 per annum of a wage cost. If the living levy was to come in, it would put my wage bill up to over €1 million. It doesn’t take a scientist to work that out that that would be totally unsustainable for most SMEs in the country.” She added that it would be more beneficial for the government to tackle the high costs of doing business and living costs in this country, such as property taxes, rates and water charges.

SIPTU vice president Patricia King, sitting on the programme’s panel agreed that Cahill made a “very feasible and valuable point” about SMEs. She pointed out that under the Joint Labour Committee (JLC) system, which is set to come into force in Ireland once again, employers who are genuinely unable to afford the Living Wage rate will be allowed to bring their case to the Labour Court and can be granted an exemption. However she added that big global companies situated in Ireland are earning billions in profits and could easily afford to pay their workers more.

Curtailing State subvention

“People on the minimum wage got a grand total of €3 a week extra in their pay packet after the tax changes which is one-fifth of what somebody on €70,000 or more gets”

“Everybody accepts that not every employer is going to be in a position to convert from the current wage structure, automatically and overnight to €11.45, so that’s not what’s going on here,” she said. “But if you look at it in the round, if you take retail [and] the accommodation sector, number one, there’s a lot of State subvention…There’s about a quarter of people working in retail, who are supplemented by a family income supplement, that’s a fact. There’s about 59% of them earning under the living wage; 68,000 people in this State earn the minimum wage. Now if you just take for instance the accommodation and food sector, one of the biggest employment pieces in that is the fast food sector. Could anybody try to tell you that the big global companies, that we know about, that are very familiar, that we can’t mention, who are making billions in profits, not millions, billions [can’t pay their employees more?]”

Taxation at fault

Paul Trevo, who owns a restaurant in Killarney, was also sitting on the panel. He noted that the issue was “a very sensitive topic” but that the government was basically looking for a wage increase to offset their inability to raise more in taxation from the multinational companies based here. “The multinational companies that are apparently making billions in profit are paying zero in tax in this country and there is absolutely no way that we can turn around and allow the small self-employed business person, of which there are over 200,000 of us here in Ireland to foot the blame for the inability of politicians to run the country properly,” Trevo said.

“How do you turn around and debate that people don’t need more money? Well you actually just don’t tax them as much and that’s the issue,” he added. “The system here is that we’re spending 20 billion a year on social welfare. For this year alone, we will borrow six billion to pay for our social welfare system. The problem is with social welfare, it’s with taxation and the systems, that’s where the issue is.”

Difficulties finding workers

At this point, presenter David McCullagh asked Labour TD John Lyons whether taxation levels were at fault, noting: “We saw in the budget that people on the minimum wage got a grand total of €3 a week extra in their pay packet after the tax changes which is one-fifth of what somebody on €70,000 or more gets, so if you were really concerned about the lower paid would you not have done more for them in the budget?” He also inquired whether the fact that some bigger companies would be paying higher wage rates, would “trickle down and the small companies won’t be able to find anybody to work for them?”

“Not necessarily,” replied Lyons. “The whole idea of a living wage is a good thing, I mean it’s good for business; people have more money in their pockets, it means they’re spending more, it also means higher tax revenues which means there’s more money to spend on public expenditure. It’s a win-win.” He pointed out that the scheme has been a success in London since Boris Johnson introduced it there, with 900 companies signing up for a voluntary code.

However, Sean Murphy, deputy chief executive, Retail Excellence Ireland (REI), argued that “it’s wilfully ignorant to compare central London with a full economy, massive employment and fantastic financial institutions paying vast sums of money, with Ballinasloe or Tuam or Ennis or towns like that that have actually not felt the heat of the return that’s going on in Dublin city centre’s night-time economy”.

“It’s wilfully ignorant to compare central London with a full economy, massive employment and fantastic financial institutions paying vast sums of money, with Ballinasloe or Tuam or Ennis”

Ireland’s high cost economy

He said that if Ireland had “a decent social housing construction programme, an appropriately measured out social welfare system, and a local public transport system that wasn’t jacking up its costs”, then we wouldn’t need a family income supplement. Paul Trevo further pointed out that the minimum wage in London is already €1 less than Ireland’s NMW. Trevo claimed the Labour Party was trying to give false hope to people in advance of a general election.

Retailers already face a number of challenges here in Ireland moreover. Sean Murphy highlighted the fact that upward-only rent reviews remain “a key challenge” for many retailers and that in “our domestic economy, we’ve had the single biggest drop in demand of 20% plus, since the year 2000, [which was] only surpassed by Iceland.” He added that PRSI changes had already impacted job growth in the retail sector. “In Budget 2014 the government doubled the rate of PRSI paid by employers for Class A workers, for [people] earning in the region of €300 a week or less. They doubled it from 4.25% to 8.5% and that is the reason why employment growth in the retail sector has actually been very soft, about 272,000 people.” He also pointed out that the revaluation of rates had strongly affected businesses. Trevo added that while a profit and loss sheet might ultimately show a profit, that small businesses would not necessarily have the cash flow needed to pay the Living Wage.

Although a mechanism has been put forward whereby the Labour Court can grant an exemption to SMEs who are unable to afford the Living Wage rate, the groups advocating this system do not seem to have addressed the cost in terms of time and money, in order for a SME employer to bring their case before the Labour Court. With Ireland already paying one of the highest minimum wages in the EU, retailers should not be afraid to speak out about how this change could adversely affect both their own and their employees’ livelihoods.

Print

Print

Fans 0

Followers