Inflationary pressures impacting Irish food and drink sector

Brexit, Covid, supply chain constraints and raw material shortages all factors in cost increases

10 August 2021

Irish food and drink businesses are experiencing inflationary pressures across most cost headings due to a combination of macro external factors including Brexit, Covid, supply chain constraints and raw material inputs, according to Food Drink Ireland (FDI), the Ibec group representing the food and drink sector.

FDI surveyed member companies in July to assess the extent and impact of input cost increases. The survey found that the majority of food and drink companies experienced substantial increases across a range of inputs over the last 12 months including:

| Cost increase over last 12 months by input | 20% or greater increase | 10 – 20% increase | 5 – 10% increase | 0 – 5% increase | No increase | Decrease | Total | ||||||||

| Raw materials | 15% | 40% | 26% | 11% | 4% | 4% | 100% | ||||||||

| Energy | 22% | 41% | 19% | 11% | 7% | 0% | 100% | ||||||||

| Packaging | 11% | 44% | 22% | 19% | 4% | 0% | 100% | ||||||||

| Transport/Shipping | 26% | 23% | 30% | 15% | 6% | 0% | 100% | ||||||||

| Insurance | 15% | 15% | 12% | 38% | 20% | 0% | 100% |

Lower but still significant increases were experienced for other inputs, including 37% experiencing 5-20% cost increases for water/wastewater and 30% experiencing 5-20% cost increases for labour.

Factors causing increases

Respondents were very clear in the main factors they attributed the input costs to:

- 100% considered Brexit very relevant or relevant

- 96% considered Covid impacts very relevant or relevant

- 96% considered global supply chain constraints very relevant or relevant

- 81% considered domestic supply chain constraints very relevant or relevant

- 78% considered raw material inputs very relevant or relevant

All businesses operating throughout the Covid pandemic have had to make significant investments to adjust operations in line with public health guidelines. Brexit has added significantly to trading costs including transport and logistics and additional administration both for trade with the UK but also for trade with the EU using the land-bridge. Transport costs have also been affected by the major driver shortage impacting that sector and for international business, the cost of freight containers has exploded since the beginning of the year.

Food businesses are also identifying strong increases in utility costs, in particular energy and also in packaging.

Paul Kelly, FDI Director said respondents expected a continuation of inflationary trends in the months ahead and that this would impact on margins and competitiveness in export markets.

He called for a range of measures to offset these impacts including a rapid roll out to the sector of funding from the Brexit Adjustment Reserve, and a renewed focus across government on reducing the cost of doing business in Ireland.

Tomato shortage

A recent example in The Guardian aptly illustrated the pressures food companies are facing. Jason Bull, of West Yorkshire-based ingredients firm Eurostar Commodities has been badly hit by shortages. His firm imports 850 tonnes of processed tomatoes a year from Italy to use in supermarket ready meals and restaurant dishes, but he says wholesale prices are already up 20%, with suppliers warning the increase could hit 50% this summer due to a shortage of the fruit and even cans for their packaging.

“At the moment there’s basically no tomatoes so everybody’s panicking and prices have gone through the roof,” Bull said. “We’ve got increased demand for processed tomatoes but they’re telling us we can’t have them, and what we can have is more expensive because they just can’t buy the tinplate for the cans.”

According to Bull, other ingredients have experienced increases too, albeit not so severely. Rice flour, used in baby food, desserts and gluten-free foods, is up 30%, while the company’s shipping costs from east Asia have increased from $1,200 per container to between $10,000 and $12,000.

Commodities data group Mintec created a cost model to reflect Bull’s experience. The cost of crushed tomatoes is up 30%, while tinplate is up 21% and even the paper used for labels is 8% more expensive, producing an average price increase of 23%.

This year-on-year comparison for May does not include other pressures such as a 281% increase in shipping costs and 119% rise in the price of Brent crude oil.

Ulster Fry Index

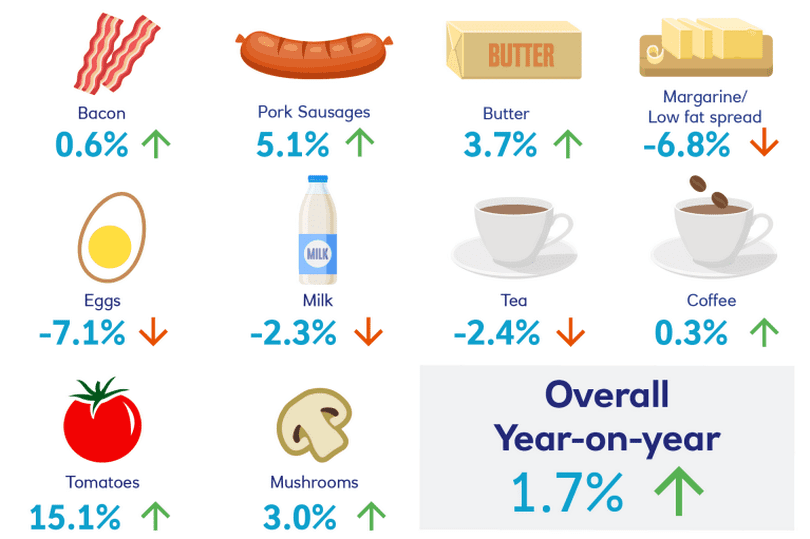

Ulster Bank recently compiled its annual ‘Ulster Fry Index’

Another index used to measure increases is the Ulster Bank’s ‘Ulster Fry Index’ released earlier this year, which examines the price change in the key constituents of the iconic breakfast dish.

It climbed by 1.7% on the year and is expected to increase in the coming year as the true impact of supply issues related to Brexit are felt, according to the bank’s chief Northern Ireland economist Richard Ramsey.

Tomatoes climbed by some 15% as the result of a poor harvest and a long winter while sausages were up 5% and butter 3.7%, believed to be caused by supply issues related to Brexit.

Ramsey said as the food chain grappled with Covid-19, it faced increased costs which have be passed down the chain to the consumer

By contrast, however, the cost of eggs dropped 7% as a result of oversupply due to restrictions on the hospitality sector while milk, tea and margarine also fell.

“This year’s rise in the Index follows two consecutive years of falls, but the long-term trend is very much upwards,” Ramsey said. “The Ulster Fry Index is 6.5% higher than it was five years ago and 23% higher than it was at the time of the last recession in 2008.”

Yet while prices for consumers have risen, it’s unlikely Northern Ireland’s farmers have benefitted. The latest government figures show farming incomes in Northern Ireland rose 27% but due to the associated hike in the costs of fuel, fertilizer and other inputs, profit margins remain slim for many farmers.

Drive towards sustainability

Meanwhile, in the Republic, the government’s new roadmap for the agri-food sector, ‘Food Vision 2030’ was launched last week, with the stated goal of enhancing Ireland’s position as a “global leader in safe, sustainable agri-food exports”.

President of the Irish Creamery and Milk Suppliers Association (ICMSA) Pat McCormack, praised the document’s ambitions, but said food prices must and will increase.

The strategy was “crippled by our official inability or unwillingness to actually state categorically to the public that food prices must and will increase as part of that drive to become more sustainable,” McCormack said.

Print

Print

Fans 0

Followers