Improved outlook for grocery sector as sales growth continues

'All to play for' in the lead up to Christmas, with the top three grocery retailers separated by less than 1.5% market share

24 November 2014

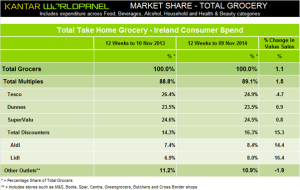

The Irish grocery market has grown its sales at the fastest rate since June with sales up 1.1% over the past year, according to the latest supermarket share figures from Kantar Worldpanel in Ireland, published today for the 12 weeks ending 9 November. This equates to an additional €23 million being spent by Irish shoppers.

David Berry, commercial director at Kantar Worldpanel, explains: “Grocery market growth has accelerated, with sales up by more than twice the average rate achieved over the course of 2014. This is in stark contrast to the Great British market which has contracted for the first time on record. One reason for this growth is improved confidence among Irish shoppers which is illustrated by a marginal return to growth for branded grocery products (0.3%). Since the recession began branded sales have been in decline, so a return to growth is a positive prospect for recovery.”

“Competition in the market is intensifying as the battle to be the number one grocer wages on. The top three retailers are separated by less than 1.5% share – a record narrow divide at the top of the market. There really is all to play for among the big retailers as the critically important Christmas period approaches.”

Tesco remains the top supermarket in Ireland with a 24.9% share of the market, despite falling sales due to shoppers putting fewer items into their baskets. SuperValu closely follows holding 24.5% of the market and is performing well with a sales increase of 0.8% driven by new shoppers. Dunnes remains in third place holding a 23.5% market share.

Elsewhere in the market, Lidl and Aldi’s widespread consumer appeal has allowed both retailers to continue to enjoy strong growth, with sales increasing by 16.4% and 14.4% respectively. Some 63.5% of all households shopped in each of the two retailers during the past quarter, with Lidl particularly benefitting from more frequent visits by customers as shoppers returned to the store for one additional trip. Meanwhile, Aldi continued to attract new shoppers bringing an additional 80,000 shoppers through its doors.

Print

Print

Fans 0

Followers