High street retail vacancy rates improve across Ireland

High street occupancy improves as occupier activity and sales grow, according to latest research from CBRE

20 April 2015

High street vacancy rates have improved in the majority of Irish cities and towns monitored by commercial property consultants CBRE over the past six months.

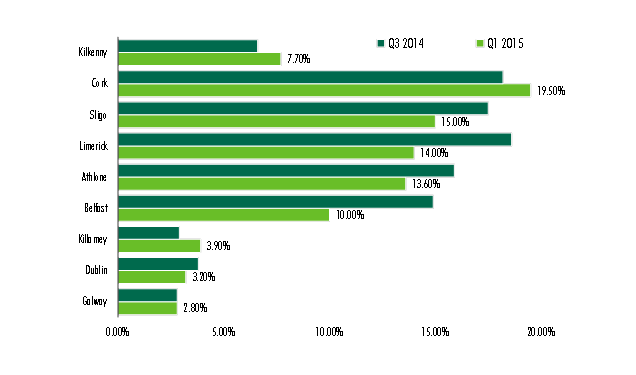

According to CBRE, in six out of the nine locations surveyed over the last six month period, high street vacancy rates have improved. The property consultants say this result is in stark contrast to this time last year, when rates were moving in the opposite direction. The prime high streets in Belfast and Limerick showed the most significant reduction in ground floor vacancy in the last six months, contracting by between 3% and 4% to stand at 10% and 14% respectively.

Sligo, Athlone and Dublin also showed an improvement in high street occupancy over the period, with the capital’s ground floor vacancy rate now standing at 3.2%. Cork, Killarney and Kilkenny showed an increase in ground floor vacancy between Q3 2014 and Q1 2015, however the agents say they are aware of a number of deals agreed in these locations which should alleviate the vacancy in coming months once signed.

Simon Cooper, senior director in the retail agency department at CBRE said: “It’s encouraging to see an improvement in ground floor vacancy rates across the country as it is not only a sign of the increased occupier activity which we are experiencing but also of local councils and landlords becoming proactive to work towards a solution to double digit vacancy rates in high street locations.”

According to CBRE, prime Zone A retail rents on Dublin’s Grafton Street increased to €5,500 per square metre per annum in Q1 2015, while rents elsewhere remained stable over the quarter. The property consultants in their report also note that 2014 was a strong year for retail investment across the country as over €1 billion was invested in the sector, followed by a further €36 million in Q1 2015. On the back of this strength in investor activity, CBRE that prime retail yields now stand in the order of 4% having contracted by 50 basis points since Q3 2014.

High Street Vacancy Rates Q1 2015 v Q3 2014 – Source: CBRE

Print

Print

Fans 0

Followers