Meat meeting targets!

Currently worth €241 million and growing by +4% year-on-year, the versatility, convenience and nutrition offered by cooked and packaged meats makes them a fridge staple your consumers will be keen to stock up on, writes Gillian Hamill

15 January 2015

AT A GLANCE: COOKED AND PACKAGED MEATS

- The cooked meats category is worth €241 million and is growing at +4% year-on-year*

- Carroll’s has grown its market share again to become Ireland’s fastest growing pre-pack ham brand** and continues to dominate the deli category, retaining its strong brand position***

- Everyday is still the largest segment of the cooked meats category, dominated by the number one branded player in the market, Denny*

- With 11.6% of the sliced cooked meats market, Denny is number one, followed by Bradys with 6.6%, Galtee with 5.8%, Greenfarm with 4.5%, Carroll’s with 4% and Shaws with 2.5%****

- Denny is the number one branded player within cooked meats, as well as the rasher and sausage categories*

- Galtee is the number two meats brand in Ireland*****

- The Galtee brand is worth €31 million and within the cooked meats category, the brand is worth €14 million, growing 30% in the last year*****

- William J Shaw opened his first shop in Limerick in 1831, and over 180 years later, the brand is worth over €9 million*

*(Source: AC Nielson September 2014 52 Week MAT VAL)

**(Source: Kantar 12 w/e 17 August 2014)

***(Source: Carroll’s internal sales figures and industry insight)

****(Source: Total Scantrack Incl Dunnes and Discounters – MAT TY Data to – Sep 07/14)

*****(Source: AC Nielson September 2014 52 Week)

Cooked meats are a staple many consumers would never go without in their fridges. Whether it is for kids’ lunches, salads, omelettes or snacking from the pack, it is one of the most versatile products consumers can buy. For that reason it is no wonder that the cooked meats category, worth €241 million, is growing by +4% year-on-year*. This growth is being driven by an increased frequency of purchase amongst shoppers, with more packs being sold.

Convenience, value and quality are prime factors within the packaged and cooked meats market. Fortunately, consumer confidence is starting to improve and the latest market statistics from Kantar Worldpanel show grocery sales are up 1.1% over the past year. The figures also reveal a marginal return to growth for branded grocery products of +0.3%. However, while Ireland is beginning to witness the positive results of improved confidence, in recent years, consumers have become accustomed to making their own packed lunches on a daily/frequent basis and this is unlikely to change anytime soon; a factor which benefits the packaged meats market. While price is an important consideration, quality is paramount. Manufacturers have worked hard to emphasise the traditional hand-crafted nature of their products and their natural goodness.

*(Source: AC Nielson September 2014 52 Week MAT VAL)

Ireland’s fastest growing ham*

Recent market data highlights that Carroll’s has grown its market share again to become Ireland’s fastest growing pre-pack ham brand and continues to dominate the deli, retaining its number one brand position.** Carroll’s has grown from small beginnings as a local success in the midlands to becoming a nationwide favourite.

Using traditional family recipes, a Carroll’s ham is carefully nurtured; hand-crafted using only the highest quality pork and slow cooked for a better taste so it truly reflects the pride, passion and heritage of the Carroll family. Carroll’s takes the time to get it right.

Carroll’s is proud to hold the Bord Bia Quality Mark of approval on its range of cooked hams. This offers customers the assurance of knowing Carroll’s hams are 100% Irish and quality assured.

Carroll’s is fully committed to giving back to the community, as its continued support of Gaelic games reaches the quarter of a century milestone in 2015. Since the beginning of county shirt sponsorship in the GAA, Carroll’s (then Carroll’s Meats) has been the only name emblazoned across the Offaly team strips. This means Carroll’s has delivered the longest running sponsorship in the GAA.

Carroll’s is fully committed to giving back to the community, as its continued support of Gaelic games reaches the quarter of a century milestone in 2015. Since the beginning of county shirt sponsorship in the GAA, Carroll’s (then Carroll’s Meats) has been the only name emblazoned across the Offaly team strips. This means Carroll’s has delivered the longest running sponsorship in the GAA.

Established in 1979, Carroll’s takes great pride in its local roots in the heart of Ireland and in crafting the finest Irish hams. Carroll’s remains a firm favourite in Irish fridges following a successful trading year in 2014. Carroll’s says the company strives towards new and exciting challenges to grow the brand further in 2015.

Established in 1979, Carroll’s takes great pride in its local roots in the heart of Ireland and in crafting the finest Irish hams. Carroll’s remains a firm favourite in Irish fridges following a successful trading year in 2014. Carroll’s says the company strives towards new and exciting challenges to grow the brand further in 2015.

*(Source: Kantar 12 w/e 17 August 2014)

**(Source: Carroll’s internal sales figures and industry insight)

Bringing the meat to the table

Everyday is still the largest segment of the cooked meats category dominated by the number one branded player in the market, Denny. Growth is coming from the value segment, where private label plays a key role but again, Denny along with Galtee, Carroll’s and Cookstown play an important role in offering consumers a value branded proposition. Wafer thin is also a segment in growth, dominated by private label, with Roscrea, Denny and Bradys being the key branded offerings. The premium segment, also in growth has strong consumer offerings from private label, Bradys, Shaws and Carroll’s.**

Kerry Foods is the market leader in the cooked meats category and its portfolio caters for premium, everyday and value segments in the market. The Kerry Foods brands Denny, Galtee and Shaws hold the number one, three and six branded market share positions in Ireland. Looking at branded share; Denny is number one with 11.6% of the sliced cooked meats market, followed by Bradys with 6.6%, Galtee with 5.8%, Greenfarm with 4.5% Carroll’s with 4% and Shaws with 2.5%.***

Number one meats brand

Denny is the number one branded player within the cooked meats, as well as rasher and sausage categories*. Denny Deli Style 100% Natural Ingredients Ham is still the only ham with no artificial additives or preservatives in Ireland. Throughout 2014 Denny took to the GAA pitches of Ireland, with the help of a number of county players as ambassadors for the brand, to sample their Denny Deli Style ham to the all-important GAA mammy and their little sporting heroes.

Denny is the number one branded player within the cooked meats, as well as rasher and sausage categories*. Denny Deli Style 100% Natural Ingredients Ham is still the only ham with no artificial additives or preservatives in Ireland. Throughout 2014 Denny took to the GAA pitches of Ireland, with the help of a number of county players as ambassadors for the brand, to sample their Denny Deli Style ham to the all-important GAA mammy and their little sporting heroes.

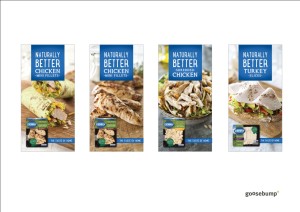

100% Natural Ham was brought to the market as a ‘better for you’ proposition by Denny, which has since launched a whole range of ‘better for you’ white meats.

100% Natural Ham was brought to the market as a ‘better for you’ proposition by Denny, which has since launched a whole range of ‘better for you’ white meats.

According to Hilary Hughes, senior brand manager, Denny: “There is a rising trend in protein consumption and clean eating. As a result, we wanted to be able to offer consumers who are looking for protein or a healthy meal solution something new in addition to our 100% natural ham, hence the launch of our new Denny white meats range. The new range includes natural carved Turkey and Chicken Slices along with accompanying Cajun & Roast Shredded Chicken and Chargrilled Chicken Mini Fillets.”

Quality at a competitive price

The number two meats brand,the Galtee range includes a variety of tasty products, made to the highest standards. The Galtee portfolio includes sliced cooked meats, rashers, sausage and pudding.

The number two meats brand,the Galtee range includes a variety of tasty products, made to the highest standards. The Galtee portfolio includes sliced cooked meats, rashers, sausage and pudding.

This Galtee range has a clear proposition for the consumer – branded quality at a very competitive price. The launch of a Galtee Value range is a testimony to the continuing power of the brand which has seen an increase in both volume and revenue sales over the past year.

As a result, Galtee remains a firm favorite in Irish fridges and is the number two meats brand in Ireland. The brand is worth €31 million and within the cooked meats category the brand is worth €14 million, growing 30% in the last year**.

Crafted quality

William J Shaw opened his first shop in Limerick in 1831. Over 180 years later, the brand is worth over €9 million*. Shaws is the premium player in the Kerry Foods portfolio offering consumers both sliced and deli meats that are true to the heritage of the brand – crafted quality from the finest Ingredients wrapped in parchment and stamped with the William J Shaw seal of approval. Shaw’s has extended its meats range this year by introducing a new premium sausage and Bord Bia thick cut beechwood smoked and unsmoked rashers.

William J Shaw opened his first shop in Limerick in 1831. Over 180 years later, the brand is worth over €9 million*. Shaws is the premium player in the Kerry Foods portfolio offering consumers both sliced and deli meats that are true to the heritage of the brand – crafted quality from the finest Ingredients wrapped in parchment and stamped with the William J Shaw seal of approval. Shaw’s has extended its meats range this year by introducing a new premium sausage and Bord Bia thick cut beechwood smoked and unsmoked rashers.

*(Source: AC Nielson September 2014 52 Week MAT VAL)

**(Source: AC Nielson September 2014 52 Week)

***(Source: Total Scantrack Incl Dunnes and Discounters – MAT TY Data to – Sep 07/14)

Print

Print

Fans 0

Followers