Discounters’ slice of Irish market still on the rise

Tesco and Dunnes experience declines in market share as Aldi and Lidl continue to impress within an increasingly competitive marketplace

18 March 2014

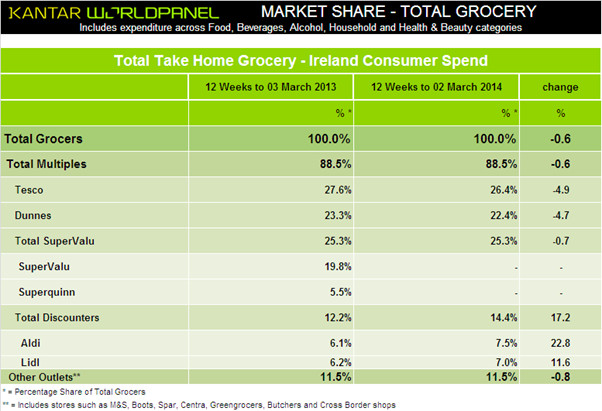

Aldi and Lidl continue to rise within the Irish grocery market at the expense of their competitors, according to the latest supermarket share figures from Kantar Worldpanel in Ireland, published today for the 12 weeks ending 2 March.

David Berry, commercial director at Kantar Worldpanel said: "Despite the overall grocery market declining for the fifth successive month, Aldi and Lidl continue to impress. Both retailers are delivering double digit sales growth, and have increased their market shares by 1.4 and 0.8 percentage points respectively. Over the past three years Aldi and Lidl have captured a combined 3.8 share points from the competition, and have grown sales by 37% in an overall grocery market which has grown by just 1%. Conversely, Tesco and Dunnes have both experienced declines in market share and actual sales as the result of the pressure exerted by the increasingly competitive market place."

The latest Kantar figures also show SuperValu has become Ireland’s second largest grocer following the rebrand of Superquinn’s stores on 13 February. Berry commented: "Bringing 24 Superquinn stores under the SuperValu banner has enhanced the retailer’s position as a major player in the grocery market. SuperValu now accounts for 25.3% of Irish shoppers’ grocery market spend, just 1.1 percentage points behind Tesco. Its sales have remained broadly in line with the market, which shows that it has been able to retain its market share while acquiring assets. Now, the main challenge for SuperValu is to convince previously loyal Superquinn shoppers of the merits of the SuperValu brand, and ultimately hold onto their custom."

February saw the grocery market’s weakest performance since September 2011, with sales declining by 0.6%. Falling inflation has played a significant part in this as vegetables and bread, two important staple items, are now cheaper than they were last year.

Print

Print

Fans 0

Followers