December drop in consumer confidence points to seasonal fear rather than cheer: KBC Bank

Analysis by KBC Ireland's Austin Hughes shows biggest monthly drop since January has seen Irish consumer sentiment end 2021 on sour note

21 December 2021

Irish consumer sentiment weakened again in December as concerns around Covid-19 and the cost of living intensified. The drop in the consumer sentiment index, to its weakest reading since February, signals a clear and material deterioration in the mood of Irish consumers of late but not a complete collapse in confidence.

Irish consumer sentiment weakened again in December as concerns around Covid-19 and the cost of living intensified. The drop in the consumer sentiment index, to its weakest reading since February, signals a clear and material deterioration in the mood of Irish consumers of late but not a complete collapse in confidence.

The sense that the pandemic and price pressures may prove more persistent and problematic than previously thought and the ghosts of previous spikes in both mean that, unfortunately, the December sentiment index speaks of seasonal fear rather than seasonal cheer.

Not unique to Ireland

However, we don’t think the December KBC Bank consumer sentiment index suggests the Irish consumer is in freefall. Nor are these concerns unique to Irish consumers. In this context, it might be noted that the drop in Irish consumer sentiment in December was notably less pronounced than in a comparable indicator for Germany; the latest reading (which is seen as relating to January rather than December!) of the GFK measure of German consumer confidence tumbled to -6.8 from -1.8.

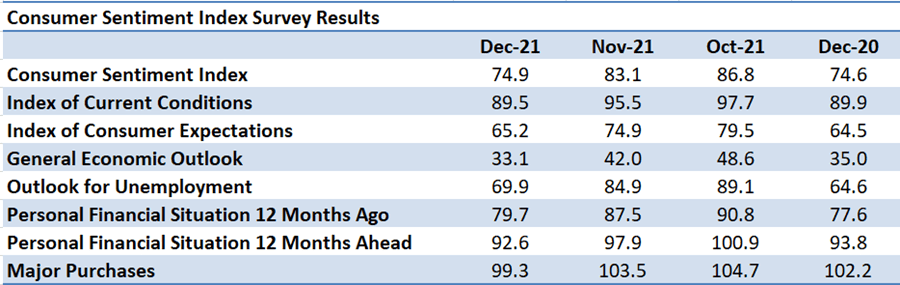

The KBC Bank consumer sentiment index fell to 74.9 in December from 83.1 in November. This brought the index to its lowest level since February (70.8). December also saw the biggest monthly fall (-8.2 pts) since January (-9.7) and it was also the third largest monthly fall since the pandemic struck. While altogether more measured than the precipitous decline of 34.7 seen in April 2020, the December change suggests Irish consumers are bracing themselves for a difficult period to come.

Factors amplifying consumer nervousness

We previously suggested that Irish consumer sentiment and spending were both becoming progressively more resilient to each new wave of Covid-19. This is altogether different to the emergence of complete economic immunity to the virus. We would highlight four factors that may have combined of late to amplify consumer nervousness.

The first two of these are health considerations. The first being the likelihood that consumers have been unsettled by the speed of emergence of the Omicron variant allied to the degree of uncertainty as to its medical impacts.

A second related consideration likely weighing on Irish consumer sentiment is the potential for a recurrence of the intensity of problems seen in the wake of the emergence of the so called ‘UK variant’ of Covid-19 (more formally ‘Alpha or B1.1.7) at Christmas time a year ago. A deflating sense that the worst of the pandemic might not be behind us likely intensified the adverse impacts on the mood of Irish consumers of late.

Surge in inflation

A further important adverse recent development is a sustained surge in inflation, particularly in energy costs of late. Again, we previously noted that the full impacts on sentiment and spending power would only become clear as poorer weather translated into greater use of home heating and car journeys. So, we may still be some way from peak problems in this respect.

In terms of the impact on sentiment and spending power, it is worth noting the contrast between the latest inflation reading for November 2021 (+5.3%) with that of November 2020 (-1.1%) or specifically for energy costs (+28% v -6.2%). In that respect, the recent sharp rise in inflation has come as a marked and most unpleasant shock to consumers more familiar with broadly flat trends in most living costs through recent years.

Renewed health restrictions

Finally, we think the employment impact of renewed health restrictions may also be weighing materially more on consumer thinking. In this context, it should be noted that the sharpest decline-by some distance-in the details of the December sentiment survey is in relation to the outlook for jobs.

This suggests that consumers see particular risks in this regard. Clearly, the longer and/or the more often the activities of certain sectors are curtailed, the greater the risk of permanent losses in future output, incomes and employment in these areas even for businesses and workers with strong underlying attributes.

The nature of the sectors most affected means that they include some of those who are least qualified formally as well those most creative culturally. In that respect the lasting economic as well as social impacts of potential losses in these areas may be altogether greater than might be implied by conventional but mechanical metrics such as ‘value-added.

In turn, these risks to employment highlighted in the December sentiment survey might suggest the need for more long-lasting and targeted structural assistance to specific sectors to ensure their capacity to contribute to a rounded Irish economy that, in turn, should underpin healthy consumer sentiment.

Weakened sentiment

All five main elements of the KBC Bank consumer sentiment survey weakened in December. As described above, the jobs element declined most. The downgrades to the broader economic outlook and consumer views as to how their household finances had developed in the past year were broadly similar. We think growing concerns around living costs and the particular squeeze on spending power at such a key time as Christmas likely contributed significantly to a re-assessment of their circumstances that prompted notably weaker sentiment.

Although both weakened relative to November, the best performing elements of the December survey were consumer thinking on how their personal finances would evolve in the next twelve months and their assessment as to whether now was a good time to buy major items. Resilience in these areas suggests that while Irish consumers may be down, they are not out.

While we felt the earlier trend in consumer sentiment through 2021 cautioned that some expectations of a consumer boom might prove excessive, equally, the December reading does not imply a collapse in consumer spending. We suggested that in relation to spending, the November sentiment reading hinted that Christmas would be cautious rather than cancelled. Together with the impact of recently increased restrictions, the drop in Irish consumer confidence in December might be interpreted as pointing towards an uneven and possibly sluggish or subdued Christmas rather than a slump in spending.

The KBC Consumer Sentiment Survey is a monthly survey of a nationally representative sample of 1,000 adults. Since May 2019, Core Research have undertaken the survey administration and data collection for the KBC Bank Ireland Consumer Sentiment Survey.

Print

Print

Fans 0

Followers