Bewley’s case throws a lifeline to retailers

Last month's ruling by the High Court in the Bewley's case will throw a lifeline to many retailers stuck in upward-only leases, but will provide no relief to those who were unlucky enough to agree new leases at or close to the top of the market, writes Dan White.

22 April 2013

Retailers have been caught in a double bind since the economic bubble burst over five years ago. Not alone has the value of retail sales collapsed by almost a quarter, many retailers are still being forced to pay the excessive rents to which they signed up during the good times. This is because most of them are trapped in leases with upward-only rent reviews. Many of these upward-only leases run for as long as 35 years.

Lost touch with reality

With the benefit of hindsight it is now clear that during the final manic phase of the boom, retail rents completely lost touch with reality. While the consumer price index rose by only 30% between 2000 and 2007, average retail rents rose by a massive 240%. Quite clearly the arbitration system, under which rents due for review were set, had become hopelessly skewed in favour of landlords.

While this might have been just about bearable at the top of the boom it is now a very different story. Unfortunately the existence of leases with upward-only rent reviews, the terms of which dictate that rents can only increase when they come up for review every five years, means that the collapse in retail sales has not been reflected in lower rents. Indeed many landlords are still using upward-only leases to demand higher rents.

This is despite the fact that, not alone has the value of retail sales collapsed, the supply of retail selling space has grown exponentially. Figures compiled by estate agent CBRE Richard Gunne show that the available shopping mall space quadrupled to 2 million square metres in the seven years to 2010 while retail park space quintupled to 1.3 million square metres over the same period.

In any normal market this combination of a collapse in sales and a huge increase in the supply of retail selling space would have fed through into retail rents. Unfortunately the Irish market is anything but normal as many retailers are trapped in leases with upward-only rent reviews. What this means is that many retailers still find themselves paying the now-excessive rents which they signed up to during the noughties.

Carnage

The result has been carnage on the main streets and in the shopping malls with a slew of retailers including Superquinn, Xtra-vision, Golden Discs, O’Brien’s Sandwich Bars, Atlantic Homecare, HMV, Hughes & Hughes and, most recently, Monsoon, having to either close their doors completely or else seek protection from their creditors.

In almost all of these cases the main creditors were landlords with upward-only leases who refused to reduce the rents being paid by their retail tenants to more realistic levels.

Government backtracking

The creation of new upward-only leases was outlawed by the previous government in 2010 in what was rightly criticised at the time by the then opposition parties as an empty gesture. However, despite the two government parties promising to abolish existing upward-only leases in both their election manifestos and the programme for government, Finance Minister Michael Noonan backtracked in his December 2011 budget speech citing "constitutional difficulties".

So why not change the constitution? The reality is that, like its predecessor, this government has been captured by the property lobby, i.e. the banks and NAMA. The abolition of existing upward-only leases would force the banks and NAMA to value their commercial property loans realistically and recognise huge losses.

Far better it seems to stick with the current non-policy of "extend and pretend".

This is despite the fact that out there in the real world retail property values and rents have long since been marked down. In February German fund manager GLL Real Estate paid €40m for two adjoining shops on Grafton Street, a 65% reduction on the price which their previous owner paid for them in 2007.

Demanding rent reductions

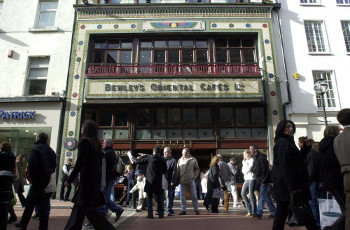

Also on Grafton Street, fast food chain McDonalds demanded a 50% reduction in its rent when its 35-year lease expired last year while Burger King was awarded a 52% rent reduction on its Grafton Street outlet when the matter went to arbitration in the High Court in 2010.

So has the judge in the Bewley’s case, Mr Justice Peter Charleton, succeeded in the High Court where the government has so lamentably failed?

Before becoming a High Court judge in 2006 Peter Charleton was one of the outstanding commercial barristers of his generation. As such he would have needed no reminding of the damage being wrought by upward-only leases on the retail sector.

In his judgement in the Bewley’s case the judge will have given hope to many, but not all, retail tenants. Basically Mr Justice Charleton, after parsing the wording of the Bewley’s lease, concluded that the landlord, the Johnny Ronan-owned company Ickendel, was only entitled to an increase on the original 1987 rent of €213,000 and not from the 2007 rent of €1.46m.

So who stands to benefit from the Bewley’s ruling? Depending on the wording, tenants who agreed upward-only leases before 2000, where the average retail lease is about 15 years old, could be the big winners. If they can base future rent reviews on the rents which they originally agreed back in the 1980s and 1990s then their rents could be halved or more.

Not everyone will benefit

However, if the landlord had sufficient foresight to insert into the lease a clause that any future rent reviews would be based on the most recent rent rather than the original rent then they are still trapped.

Tenants who signed up for leases much after about 2000 don’t even have the hope of that get-out-of-jail card as their most recent rent would be either the same or close to their starting rent.

By going as far as he dared, Mr Justice Charleton has thrown a lifeline to many desperate retailers. It is now up to the government to finish the job and abolish existing upward-only leases once and for all.

Print

Print

Fans 0

Followers