Accounting and payroll minus the headache

Recession or not, agonising number crunching doesn’t have to monopolise retailers’ valuable time. There are many advantages to using a payroll and accounting solution, either in-house or outsourced

15 April 2009

In the current economic climate, retailers are reporting it is more important than ever they keep inside their forecasted wage budgets.

While being a percentage point or two over budget during a week in 2008 may not have presented a major cause for concern, in 2009 controlling costs has certainly assumed greater importance.

Keeping a tight rein on business costs such as wages needn’t present an administrative headache however.

There are several solutions specifically designed to aid retailers in this area. These include three main options of outsourced packages, in-house installed software and on-line accounting solutions.

Programmes such as these also ensure that retailers keep fully up-to-date with the latest Inland Revenue legislation. A consideration that is of particular importance at the current time; with Minister for Finance Brian Lenihan preparing

April’s ‘emergency budget’, as ShelfLife goes to print.

Of course, having a programme which can be relied upon to help pay staff accurately and on time, frees up important time for retailers to concentrate on the core functions of their business; maintaining customer satisfaction and margins.

Reacting faster

Roddie Ahern, business director of leading global human resources software and services provider NorthgateArinso, has spent 30 years working in payroll in the UK and Ireland, and agrees that the right systems can help businesses react faster to changes in the marketplace. "In today’s challenging world, the ability to react quickly to changes in its business environment is vital in ensuring survival for any sort of organisation.

"Companies may be facing the reality of needing to reduce their workforces but, most importantly, they must also ensure that key skills required within the business are retained and developed so that advantage can be taken of opportunities that present themselves in the future. Investment in the right systems will aid in achieving such goals."

Ahern believes that outsourcing payroll and accountancy functions is the way forward for many retailers. In his view this is especially true considering that "funding levels are currently very tight and often needed to support day-to-day activities rather than longer term investment in systems."

Far-reaching benefits

Roddie Ahern, business director of human resources software and services provider NorthgateArinso

NorthgateArinso, says Ahern, can deliver critical HR and payroll services, with minimal up-front investment. But while NorthgateArinso "embraces the philosophy" that outsourcing these key functions can streamline and reduce operating costs, Ahern believes this is not all outsourcing can deliver for a retailer. "We also believe that the strategic advantages, gained through the use of our integrated systems in an outsourced environment, deliver far reaching business benefits," he comments.

"NorthgateArinso’s outsourced solutions remove the disadvantages created by disparate systems, multiple providers and the uncertainty of interfaces and data transfer usually associated with old style providers."

Ahern says as well that NorthgateArinso’s outsourced services are "functionally rich and supported by seasoned payroll and HR professionals." So what added advantages can such services deliver for retailers? The first point Ahern notes is that, "NorthgateArinso’s ResourceLink application, a fully integrated HR, payroll, time and attendance, and pensions solution, underpins the success of our outsourcing solutions."

"Our single HR/payroll database structure ensures our clients benefit from dynamic ‘real time’ data, with integrated modules, including training, recruitment, employee self-service, and many more, provided and supported by industry specialists," he added.

Ahern believes the benefits of outsourcing are clear. They not only allow a business to implement greater cost control, but also allow it to concentrate on profit-making activities and on developing new products and services. However, he also notes that the decision to outsource must be driven by the needs of the individual organisation.

NorthgateArinso, aims to help customers find the solution that fits best with their particular circumstances. Retailers may prefer to use the ResourceLink programme in-house, and this option is also open to them. However Ahern believes ResourceLink can add most value when it is delivered as part of an outsourcing package. He explains that this package can take many forms moreover.

Keeping customers informed

"For example, Northgate can host the complete application in its state of the art data-centre. The client can access the HR side of the application as if it is an in-house solution, its employees and managers can access also self-service over the web, while Northgate, accessing the same database, can provide a fully managed outsourced payroll service."

He adds that NorthgateArinso is "committed to ensuring our customers are kept fully abreast of latest market thinking and issues to facilitate their decision making processes."

He is understandably proud of the company’s track record also, which sees it working in collaboration with companies of all sizes in Ireland and in 30 countries across the globe. He adds that, "By seeking the views and experiences of users across all sectors we are continually breaking new ground in best practice provision."

In-house efficiency

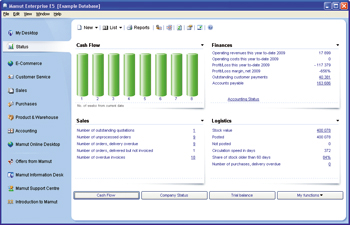

However, Luke Buckley, country manager for Ireland at Mamut, puts forward a good argument for in-house solutions also. These, says Buckley, can help small and medium businesses improve efficiency and keep costs as low as possible. A key point he makes is that programmes such as Mamut Payroll, have been created with ‘ease-of-use’ given key consideration. The screen interface for Mamut programmes, says Buckley, has been designed according to customer feedback, which makes them easy to navigate.

Mamut also offers retailers the chance to run a free ‘try before you buy’ demonstration online, so that customers can be confident they are making the right purchase for their business. The demo which can be accessed online at www.mamut.com/ie, asks various questions. These determine factors such as how many people will need to use the programme in your business, and allows the demo to be configured to meet a retailer’s specific needs.

Mamut’s payroll programme, also allows small and medium businesses to deal with all elements of payroll registration, pay slip production and subsequent reporting simply and efficiently in-house. Buckey states that there are many advantages to such an in-house solution. For example, it cuts back on the amount of training that needs to be given to new payroll and accountancy staff. It also, he believes, saves valuable time for those in management.

Unique features

The Mamut Payroll programme also offers many clever and unique features that aren’t included in other payroll software. For example, Mamut Payroll can help payroll personnel deal efficiently with benefit in kind (BIK) payments and disability allowances. In the case of BIK, payroll personnel can select from over 30 predefined benefits or input your own BIK parameters.

The appropriate tax is calculated automatically, and the programme ensures that any payments made will be fully compliant with Inland Revenue rules. Social welfare payments including disability benefit, are also easily calculated in Mamut Payroll. All possible scenarios are catered for, and the system also allows either party to keep the social welfare cheque.

What’s more, there is no limit to the number of payment elements that a company can set up on Mamut Payroll. A retailer can add their own payment elements to Mamut’s already extensive list. Another benefit delivered by the programme is that it allows employees to view payslips in real time.

The staff member can zoom in, zoom out, and select printer options, with a fully functional reporting interface. It is also possible to see how each payslip has been calculated, including being able to view the full payment history of each employee on one screen. The task of payroll personnel is also made less cumbersome by being able to use ‘period view’ to help pay employees.

Buckley adds that with the Mamut Payroll offering, the company has delivered "great value at a low price. Mamut Payroll is available for €99 per licence and €14 per month for the service agreement."

A one-stop shop

Mamut’s accounting software also offers an all-in-one comprehensive option for small and mid-size companies. But not only does this software streamline routine tasks, but it can also provide thorough in-depth analysis required for management. Mamut claims that the system is simple to set up and users can get started straight away. Mamut’s accounting software in a nutshell:

- Suitable for those who only require accounting functionality accounting software

- User-friendly journal entry in user-defined chart of accounts, with journal templates/automatic account coding, which greatly simplifies bookkeeping

- Laid-out nominal ledger with options for drill-down and analysis

- Quick, complete customer and supplier ledgers

- Wizard for VAT, period and annual closure

- Option for project and departmental accounts

- Efficient ledger management with remittance, reminders, credit charging and debt collection

- Advanced budgeting, reporting and analysis

- Automatic management of currency accounts

- Management of electronic documents linked to the accounts

So, whether you decide your business would derive most benefit from an in-house or outsourced solution, it is hard to dispute that solutions in both areas can drive greater efficiency. It seems fitting that the last word on balancing the books in order should go to a retailer.

According to Mark Cantillon, manager of Eurospar, Little Island, Co. Cork, continued retailing success is "a matter of watching everything and making sure that your budgets and your targets are coming in on line." Never a truer word spoken, many retailers would no doubt agree.

Print

Print

Fans 0

Followers