Surge in energy costs pushes inflation up, with faster increases to come

Food price inflation edged up to 3.1% from 3.0%, while there were significant price hikes for flour and pasta

12 April 2022

Consumer prices were 6.7% higher in March than they were just a year earlier, KBC has said. This is markedly faster than the 5.6% increase seen in February and the fastest pace of increase since November 2000 (+7.0%).

As has been the case for some time, the key culprit in the March inflation uplift was energy costs. Indeed, six of the twelve main commodity headings in the basket of goods and services used to measure Irish consumer prices showed lower year-on-year inflation in March than in February, an outturn that suggests price pressures are still concentrated in a small but significant number of areas.

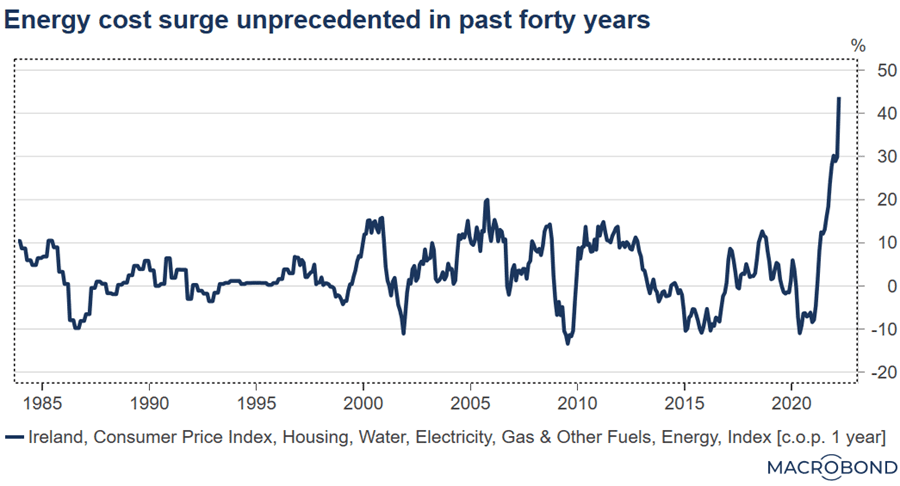

A record 18.7% monthly increase in energy costs means they are 43.8% higher than in March 2021. This scale of increase is without comparison through the past forty years, as the diagram below illustrates.

While there were significant monthly increases in motor fuel (+13.7% month-on-month to leave them 40.4% higher than a year ago), the main push came from a 58.5% month-on-month rise in home heating oil that translates to a staggering 126.6% year-on-year increase. In addition, higher energy costs undoubtedly drove an 18.2% month-on-month jump in air fares that brought the annual rate to 69.2% from 42.3% in February.

Food price inflation edged up to 3.1% from 3.0%. While there were significant price hikes for flour and pasta, the CSO food price measure is not yet reflecting the sharp increase seen in input prices.

A significant domestic driver of inflation is housing rents but the year-on-year increase in this area remained at 9.2% in March. Accommodation costs increased 5.5% month-on-month to stand 13.7% above their March 2021 level, while bar and restaurant prices rose 1.6% month-on-month to stand 2.6% higher than a year earlier.

Inflation; even worse news

KBC added that inflation looks set to climb higher in coming months: “Where precisely it may peak is almost impossible to say given current uncertainties around energy costs but, on current trends, inflation may hit 8% by summer. What seems to be becoming clearer is that current price pressures also seem set to last longer than previously thought.

“It had been expected that inflation would ease back markedly later in 2022 on some pull-back in oil prices. However, war in Ukraine means energy costs are now likely to remain elevated for some time. Food prices are under marked upward pressure because of higher input costs and war-related supply disruptions. The larger and longer energy driven surge in inflation is also spilling over into broader cost pressures across a range of other areas.

“For these reasons, only a modest retracement of current upward momentum now seems likely to occur later in 2022. As a result, we have revised up our forecast for average inflation for 2022 to 7% from 6% previously and now see inflation falling to a still troubling 4% in 2023 (previously 3.5%).”

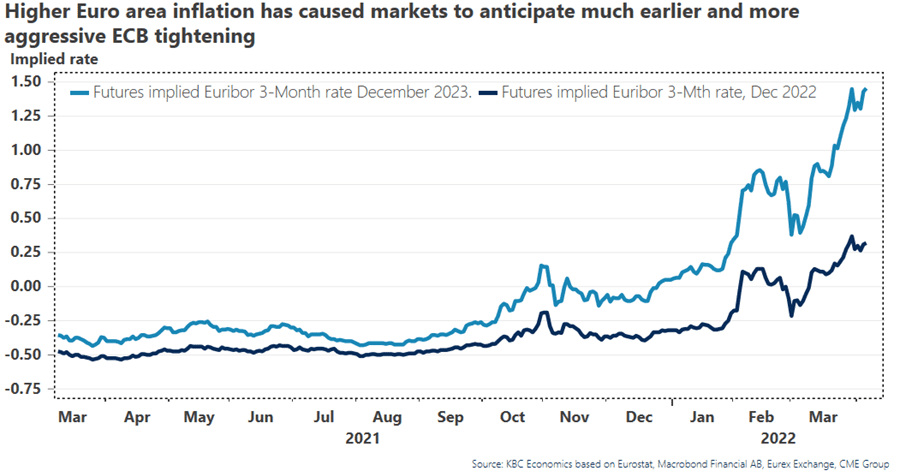

The sense that inflation problems may be much larger and longer lasting is not unique to Ireland, ir added. “As a result, an important and emerging consequence of rapid inflation globally is a much earlier and more substantial turn in the interest rate cycle. It is now widely envisaged that Central Banks will respond forcefully and quickly to the persistence of way above target inflation.”

The diagram below shows financial market expectations for the level of short-dated interest rates at the end of 2022, 2023 and 2025, Markets now take the view that the ECB could raise rates three times by the end of this year and by a similar amount next year.

The change in market thinking is largely a response to the unexpected strength and length of Euro area price pressures but it also reflects subtle but significant changes in the tone of comments by ECB officials.

In this context, remarks earlier this week by influential ECB executive board member, Isabel Schnabel, clearly warn of looming changes to ECB policy.

Schnabel suggested that there should be some offsetting role for fiscal policy: “If, however, the shock is expected to be more persistent and to affect inflation over the medium term, monetary policy needs to act in order to remain faithful to its primary objective of price stability. Then, fiscal policy should ideally buffer the effects on private demand.”

Print

Print

Fans 0

Followers