Irish consumer confidence steady but still subdued in April

Analysis by KBC Ireland's Austin Hughes shows consumer sentiment holds at 13 month high but remains below long term average

27 April 2021

Irish consumer sentiment held steady in April as encouraging news about the economy was tempered by concerns about the outlook for jobs while mixed views on household finances translated into continuing caution in spending plans.

The stable confidence reading likely reflects an Irish consumer increasingly hopeful of improving news about Covid-19 but also hampered by uncertainty about its longer term economic consequences.

The KBC Bank Irish consumer sentiment index edged up to 77.9 in April from 77.1 in March with this marginal gain effectively signalling no material change in consumer thinking overall this month.

The April outturn means the sentiment index is now at its strongest level in 13 months. It is also the first time in 33 months that the sentiment reading has been above the corresponding month in the previous year. However, this result underlines that a downtrend in Irish consumer confidence had been firmly established prior to the pandemic. As a result, the April reading remains well below the 25 year series average of 86.8.

As in March, consumer sentiment was boosted by solid data and strong domestic and international forecasts for the Irish economy. With encouraging news also emanating from key trading partners such as the US and UK, the broad economic backdrop seems to be developing in a favourable manner.

Cautious outlook

The details of the April survey emphasise a still markedly cautious outlook in relation to economic prospects; just over 1 in 4 consumers expect a stronger Irish economy in the next twelve months whereas just under 1 in 2 expect further weakness. That said, the April reading marks the first time negative responses have outnumbered positive ones by less than 2 to 1 since June 2019.

While the outlook for economic activity has improved somewhat of late, concerns about lasting ‘scarring’ from the pandemic in the shape of permanent job losses have attracted more attention of late.

Risks to employment in areas of the Irish economy that have endured extended constraints on activity have become an increasing focus of recent commentary and this may have contributed to a weakening in the jobs element of the April sentiment survey. It should be noted that this decline was marginal and a significant improvement in this area of the survey in recent months means that positive responses in relation to job prospects remained only modestly below negative ones in April.

To the extent that there have been recent developments affecting the incidence of the Covid-19 virus and the roll-out of vaccinations, the survey results suggest that Irish consumers reasonably see the most immediate impact on the general economic environment rather than on the specific circumstances of individual households. As a result, the elements of the sentiment survey focussed on consumers’ own personal finances have moved relatively little in recent months.

Modestly improving trend

The expectation of a post-pandemic economic rebound means that a modestly improving trend in the outlook for household finances was sustained in the April survey but it remains the case that more consumers see their circumstances weakening in the coming year than anticipate gains.

There was an offsetting weakening in consumer thinking on the development of their personal finances through the past twelve months. At the margin, this drop may have been influenced by a marked trend increase in energy costs as well as a clear pick-up in consumer prices in a range of areas of late that may also reflect Brexit related impacts.

In these circumstances, it isn’t surprising that there was little change in consumer purchasing intentions, with responses to this question also continuing a modestly improving trend but also continuing to reflect a modestly greater number of negative responses than positive ones.

Again, we would infer from these results that there is no widespread feverish anticipation by Irish consumers of increased opportunities to spend in coming months. While we see a forceful and front-loaded improvement in consumer spending, its intensity may fall short of some expectations.

Capacity to handle a financial emergency

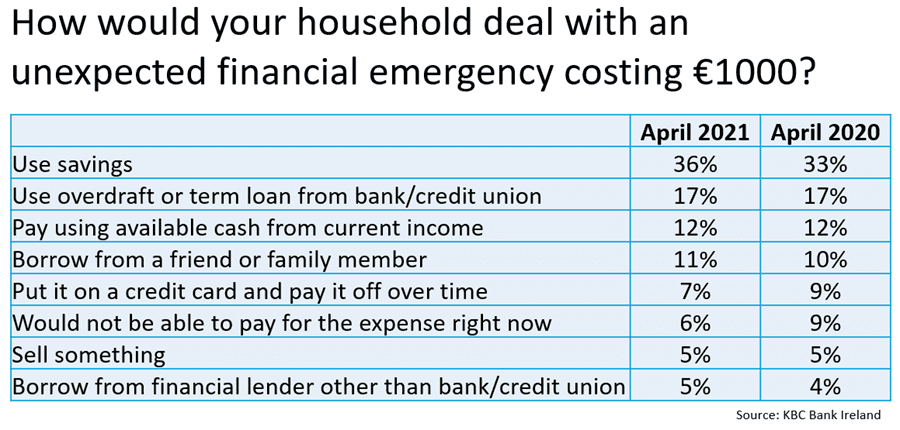

In the April 2021 sentiment survey, we repeated a question asked a year ago about Irish consumers’ capacity to handle an unanticipated financial emergency costing them €1,000. This question is based on one asked regularly in a survey of the financial wellbeing of American households conducted by the US Federal Reserve.

The table below shows the main results of responses to this question given this month and, for comparison purposes, to the survey of a year ago.

As was the case a year ago, the most common response to a financial emergency would be to draw down savings. Some 37% of Irish consumers say they would dip into their savings to fund an unanticipated outlay. This is clearly but not categorically higher than 33% who gave this response a year ago and suggests some moderate increase in the savings capacity of Irish households.

Apart from using savings, the most common response to an unexpected financial problem would be to access a loan from a bank or credit union. Some 17% of consumers would look to this form of credit in such circumstances, the same proportion as in 2020.

A smaller but still significant 12% of consumers would fund a financial emergency out of current income, again matching the results from a year ago. Encouragingly, and perhaps surprisingly in light of the economic damage caused by the pandemic, this month’s survey saw a slightly smaller 6% of consumers indicate that they would be unable to manage a €1,000 financial emergency compared to the 9% who indicated that was the case in 2020.

In broad terms, the 2021 responses to the financial emergency question point towards substantial differences in the capacity of Irish consumers to cope with a financial emergency at present. Encouragingly, it also suggests a slightly improved capacity overall to handle such a problem.

The relatively modest increase in numbers drawing on savings and similar drop in those unable to handle such a difficulty would appear to suggest that widespread fiscal supports have had a positive impact on the sustainability of household finances.

The modest increase in the share of consumers relying on savings in these results might also hint that improved savings capacity has been most pronounced in more financially comfortable groups who could use their current incomes to respond to a financial emergency of this magnitude (because using credit would be more costly than using savings).

Print

Print

Fans 0

Followers