Understanding the Irish consumer

The Pulse study was launched in November 2009 as a joint venture between Carat Ireland and iReach Market Research designed to take the monthly ‘pulse’ of the Irish consumer. Dael Wood, director of insights & strategy at Dentsu Aegis Networks, a multinational media and digital marketing communications company, discusses the results

11 February 2015

Can you explain what the Pulse study is about?

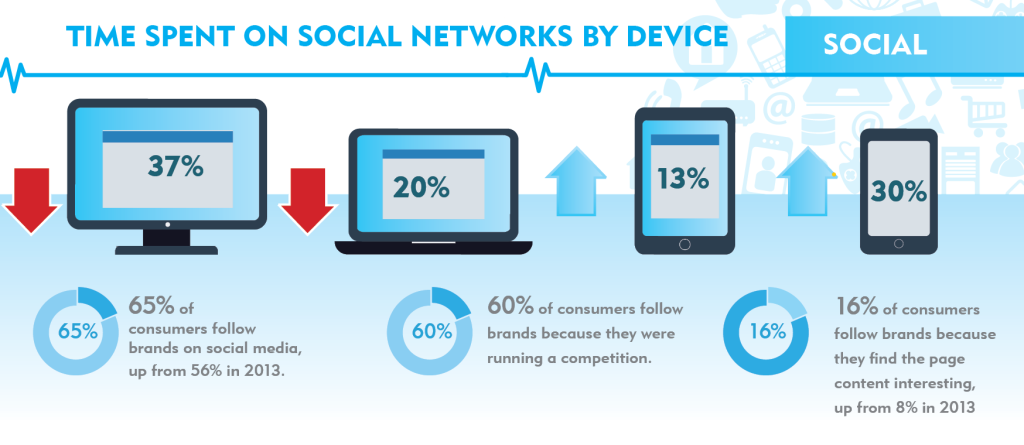

We started the Pulse study at the end of 2009 in response to an increasingly complex media environment that shifted the focus from reaching people en masse to connecting with people in a meaningful way. With consumers more connected, through a range of devices, than ever before, the era of media convergence is presenting many opportunities as well as a new, complex media eco-system. This means that understanding consumers is more important than ever and the Carat Pulse study is one of the ways that we ensure that we are keeping our finger on the pulse of changing and evolving trends in Ireland. We partnered with iReach to reach out to a nationally representative panel of 1,000 Irish people every month to find out how they feel about everything from health and fitness to shopping at the grocery store. At the end of each year we compile a summary of these findings which provides a comprehensive snapshot of the year.

Is seems like shopper behaviour is becoming more stabilised. Why do you think this is so?

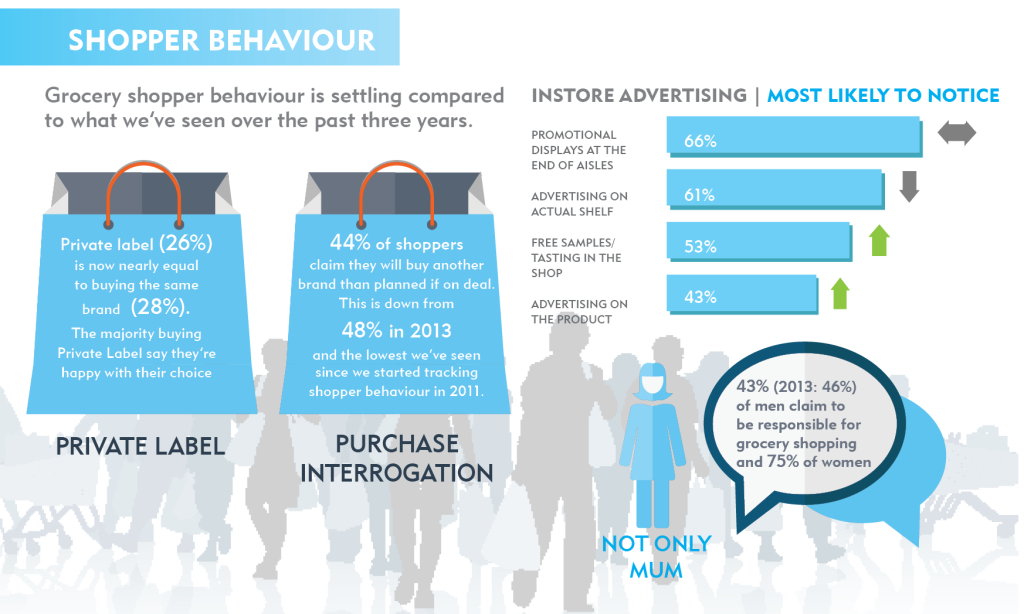

We have been tracking shopper behaviour through our Pulse study for four years now and there is some indication that shopper behaviour is becoming a little more stabilised. We think that the reason for this is, that as we moved into recession in 2008, shoppers were forced to significantly re-evaluate their shopping behaviour and as a result, many brands responded over the years by aggressively competing through price and promotion simply to survive. Two things happened in 2014 that show a more stable shopping environment. Firstly, from a consumer perspective, as the recession hit, shoppers were forced to re-think how they shop and the choices that they made as a result of a reduced income. This meant more experimentation with different brands (on deal) and buying private label alternatives. Through this experimentation, they have found a new shopping basket that meets their and their families’ needs and also their new budgets. In 2014 the more settled behaviour was apparent in our research with a decline in time spent in-store comparing prices and shopping for better prices. The other driver of this stabilisation was undoubtedly many brands having to revisit their strategy of aggressive trading as this was simply not sustainable from a business perspective.

I think the recession has brought with it a “new normal” in Ireland with consumers now active value interrogators

Do you believe that consumers are less prudent about their spending than in previous years?

The simple answer is no. I think the recession has brought with it a “new normal” in Ireland with consumers now active value interrogators. Today, we are emerging from the brutal economic reality of the last few years, as stronger, more experienced and more informed shoppers. We can see many signs of a new sense of ownership and this new empowered consumer needs to be taken seriously by brands.

The other factor impacting online shopping and banking is the proliferation of smart devices (phone or tablet) and the response by companies building better user applications on these devices

Have you seen a huge shift in how consumers use the internet for shopping and banking?

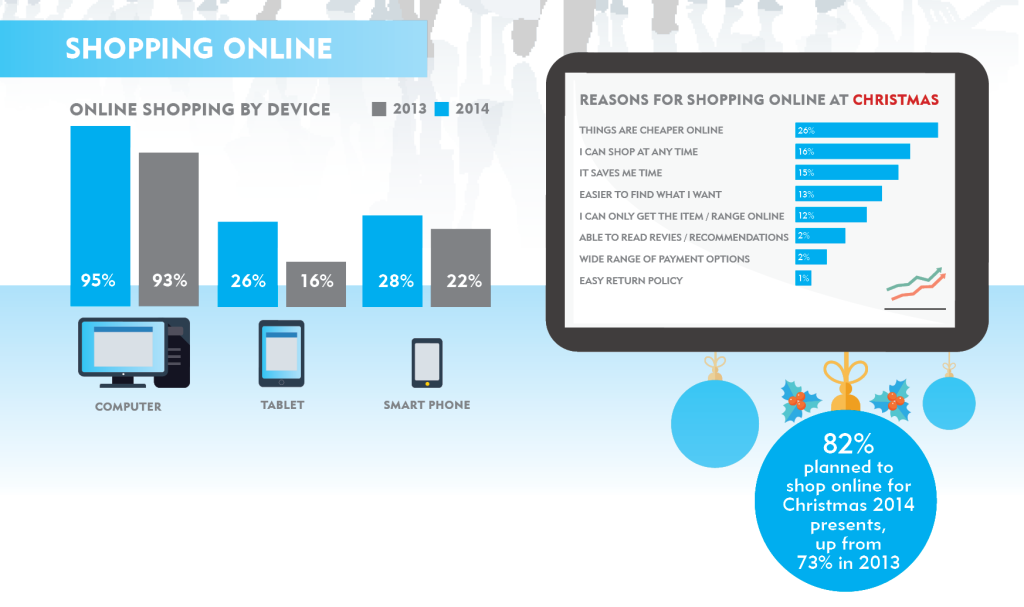

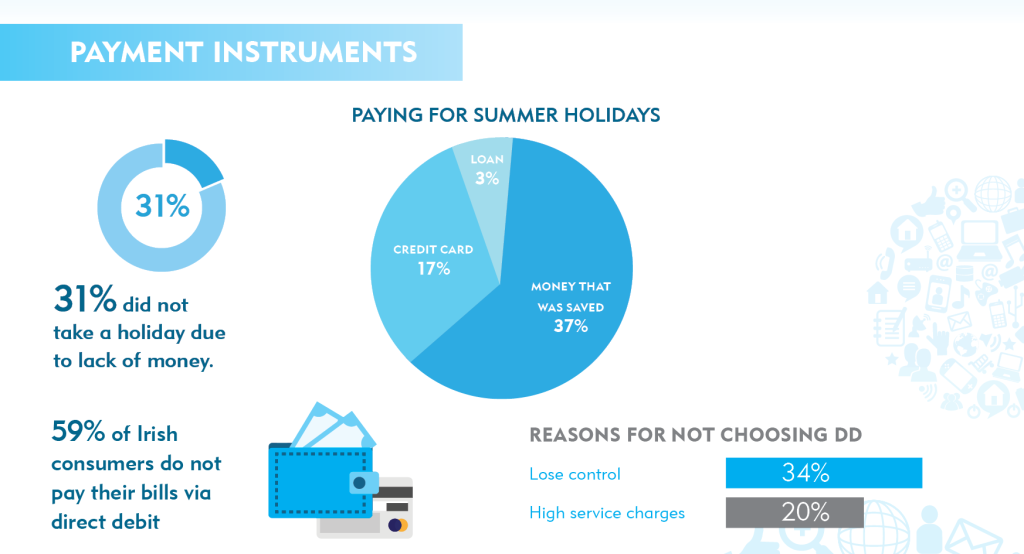

The Christmas shopping study that we published in December, answers that question very conclusively with 82% of shoppers saying that at least part of their Christmas shopping will be done online. This was up from 73% last year. Convenience and value are the big drivers behind this growth. When we looked at this from a payment instrument perspective in our July study these drivers were similar with ‘staying up to date on my bills’ and ‘easy to do’ being quoted as the reason for choosing online payment options. The other factor impacting online shopping and banking is the proliferation of smart devices (phone or tablet) and the response by companies building better user applications on these devices. We saw that 28% of people were shopping online using their phone and 26% using their tablet in our online shopping edition in March – up 8% and 10% respectively.

Print

Print

Fans 0

Followers